The global machinery sector has recorded a steady growth rate due to increased economic activities across the world. More businesses are investing in machines that help them improve operational efficiency, productivity, and performance while at the same time lowering costs.

This market growth is evidenced in the global industrial machinery market value, which grew at a compound annual growth annual (CAGR) of 9.7% from US $461.89 billion in 2021 to US $506.51 billion in 2022. The accelerated demand for machinery resulted from regional industrialization and increased infrastructure construction projects.

Table of Contents

Overview of the global machinery industry

Types of machinery

5 trends in the global machinery sector

Conclusion

Overview of the global machinery industry

Thriving in the global machinery industry requires understanding market trends, opportunities, and other data that helps understand demand forecasts for better targeting and customization. This section provides data that creates a clear picture of the market outlook for informed decision-making.

Market size and potential

The global industrial machinery market grew at a CAGR of 9.7%, from US $461.89 billion in 2021 to US $506.51 billion in 2022. The market forecast shows that sales for industrial machines will increase to US $703.68 billion in 2026 at a CAGR of 8.6%.

These statistics indicate a market potential that businesses can leverage to enhance their competitive advantage and financial performance.

Factors driving the demand for machinery

The market growth will be facilitated by multiple factors, including:

- Government and private investment in infrastructure development activities

- Industrialization as governments and companies strive to increase productivity and drive regional and international economic growth

- Increased agricultural activities to increase food production and meet domestic and internal food demand

Types of machinery

The industrial machinery market involves the sale of different industrial machines, which include:

1. Woodworking and paper machinery

The global woodworking and paper machinery market grew from US $36.42 billion in 2021 to US $40.61 billion in 2022 at a CAGR of 11.5%. The market size is projected to grow to US $60.03 billion in 2026 at a CAGR of 10.3%.

The woodworking machinery comprises multiple machines, including circular and band sawing equipment, planning machinery, and sanding machinery. On the other hand, paper machinery includes machines for making paper and paper products such as pulp-making machinery, paper and paperboard converting machinery, and paper and paperboard-making machinery.

2. Construction machinery

Multiple countries worldwide are experiencing massive demand for construction equipment due to increased building activities for infrastructure development. For example, the US construction market is projected to grow at a CAGR of 6% between 2022–2028. This growth is attributed to explosive economic and geopolitical developments across the country.

3. Printing machinery and equipment

Recent years have seen an increased demand for printing machinery and equipment such as printing presses, prepress, and binding equipment. The market is projected to grow at a CAGR of 10.2%, from US $46.58 billion in 2021 to US $76.3 billion in 2026. This market growth rate is driven by high sales of printing products, including books, magazines, newspapers, business cards, stationery, and labels.

In addition, the sector is experiencing rapid technological advancements, including the increased application of emerging technologies, such as 3D printing, artificial intelligence, and big data analytics. Examples of the latest innovations are instant and on-the-go printing and wireless connectivity in portable printers.

4. Food production machinery

Rising per capita disposable incomes are increasing the demand for food, resulting in increased food production. As a result, manufacturers in the food production industry are embracing technologies and equipment that help increase productivity, ensure food safety, and strengthen the supply chain across geographies.

This has increased the global food processing and handling equipment market value from US $101.23 billion in 2021 to US $105.13 billion in 2022. The market value is further projected to grow to US $140.17 billion by 2029 at a CAGR of 4.2%

5. Mining machinery

The mining equipment industry has been experiencing steady growth due to the increased adoption of battery-operated or electric mining machinery, which improves operational costs and safer working conditions. This has escalated the market value, estimated at US $29 billion in 2020 and projected to grow to US $36.2 billion by 2025 at a CAGR of 4.5%.

5 trends in the global machinery sector

Modern machinery incorporates advanced technologies to increase productivity and profit margins, and lower operating costs. Thus, the top 5 emerging trends and technologies include:

1. Customization

There comes a time when the off-the-shelf machinery won’t work for many manufacturers, forcing them to go for machines tailored to meet their companies’ specific needs. Especially with the current technological advancements, companies are constantly changing and adapting to new trends in the industry. Customization provides the flexibility required to adopt these changes regularly.

For example, manufacturers often need a machine that can guarantee consistent results, produce a new product, reduce downtime, or increase the current production rate. In this case, a custom machine may be necessary if the existing machinery lacks the essential functionality or is not optimized to meet these needs.

2. 3D printing

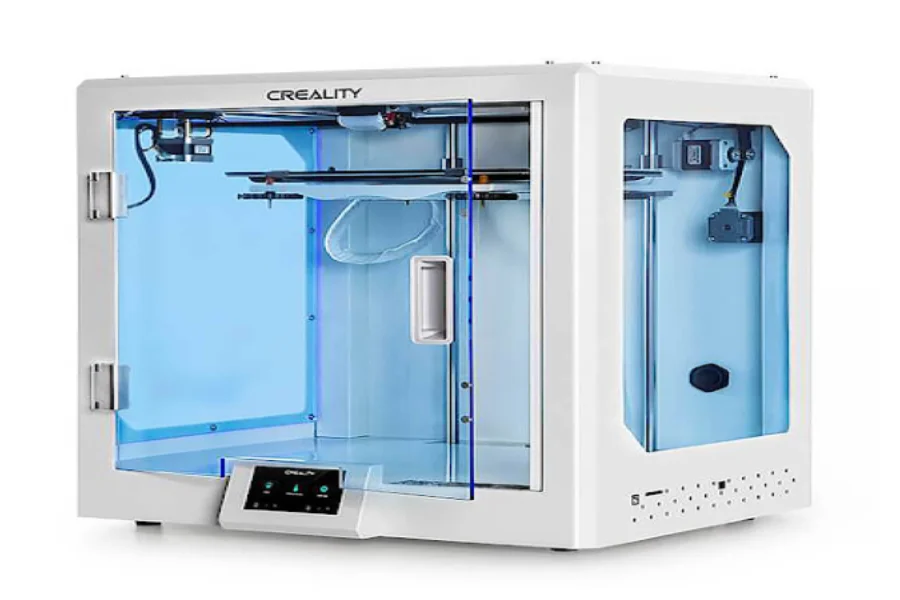

3D printing technologies or additive manufacturing are used in designing products. It provides digital design tools that help product designers create prototypes faster and more cheaply.

Machinery manufacturers can leverage 3D printing to build replacement tools or parts for the manufacturing equipment itself. For example, Caterpillar uses 3D printing in designing prototypes and manufacturing tools.

3. Artificial intelligence (AI)

Industrial machinery is often used in manufacturing shop floors, which are hugely data-driven. Integrating artificial intelligence (AI) into these machines makes it possible to extract and effectively utilize data.

The installation of artificial intelligence-capable machinery in the industrial manufacturing sector is projected to grow at a CAGR of 60%, reaching 16 million units by 2024. This is because machinery manufacturers increasingly leverage AI to predict complex interactions between each production unit and automate component order requests.

In addition, AI can help manufacturers automate visual inspection and detect faults in small equipment components.

4. Predictive maintenance (PdM)

Predictive maintenance (PdM) is a condition-based maintenance approach that helps companies monitor equipment status, health, and performance. It involves using data analysis tools and techniques to detect potential equipment and process defects and anomalies in operations.

Manufacturers and other industry professionals ensure proper machine functioning by monitoring the current state and scheduled components or fluid replacements, for example, time-based maintenance.

PdM supports these processes by integrating sensors and advanced control features to monitor key performance indicators in equipment. As a result, it provides real-time data on operational variances that could lead to machine failure, allowing operators to fix the problem before it occurs.

5. Automation

Manufacturers are increasingly adopting automation and robotics to enhance and maintain production. Industrial automation involves using multiple technologies, including sensors, machines, processors, actuators, and networks, to automate production tasks.

Robots can be easily scaled up or down to meet a company’s production needs and can be programmed to work in shared environments with workers, taking over roles such as heavy lifting or risky repetitive tasks. Therefore, automation and robots help manufacturers reduce operational costs and the potential for human error while increasing operational efficiency, productivity, and margins.

Conclusion

Most trends in the current industrial machinery sector involve integrating advanced technologies, including 3D printing, predictive maintenance, AI, automation, and customization. Manufacturers realize the benefits of these innovative technologies in the contemporary data-driven business environment.

Examples of these benefits include:

- Improved operational efficiency, productivity, and profit margins

- Reduced operational costs

- Reduced downtime

As a result, there is an ongoing high demand for industrial machinery that incorporates these trends and technologies, resulting in rapid market growth. This situation presents an opportunity for businesses that supply these industrial equipment as whole units or parts.