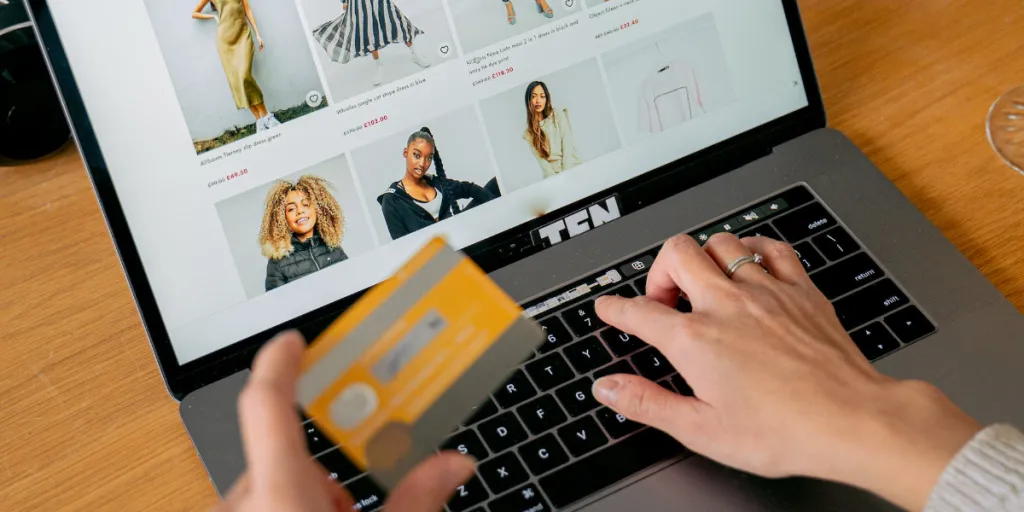

GlobalData’s Payment Revenue Models in 2021 and Beyond report, highlights that the payment revenue has increased over the past decade largely as a result of a movement from cash to cards. Increasingly consumers are moving to online payments through their mobile phones.

Key findings discussed in the report:

- Between 2010 and 2020, global payment revenues saw consistent growth, doubling to $2 trillion over the decade (Source: McKinsey).

- Two key revenue streams – interchange fees and merchant service charges (MSCs), both specific to card-based transactions – account for around half of payment revenue. Together they will see growth of 25% between 2020 and 2023, when their value will reach $1.2 trillion.

- Global cash transaction volume at the point of sale dropped 10% between 2019 and 2020 (source: Worldpay) as a result of the pandemic.

- Our data shows payment volumes at 3,493 billion in our 2023 forecasts, having more than doubled over the preceding 10 years, meanwhile value will stand at $1,426 trillion – a growth of 146% over the same period.

- In the UK, BNPL has been used by over three in 10 people cutting into credit card revenues. With 8.6 million planning to use BNPL in the future, we can expect more consumers to move from credit cards to BNPL going forward.

- While payment cards remain the dominant payment mechanism in Europe and North America, the proportion of global transactions accounted for by mobile wallets has increased rapidly. This trend will continue out to 2023, driven by especially strong usage in the Asia Pacific and growing adoption in the developed world.

Despite numerous interventions to cap interchange fees, the shift to electronic payments worldwide has enabled revenues to keep growing. Our analysis shows that a combination of interchange fees and MSCs from card payments accounted for around $1 trillion in 2021. This figure is set to rise to $1.2 trillion in 2023. In 2021, credit transfers are estimated to account for 80% of global payment value but just 5% of volume. Mobile wallets account for the largest share of volume, followed by cash and payment cards: together these mechanisms make up 92% of the volume but 8% of value.

Source from GlobalData

The information set forth above is provided by GlobalData independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.