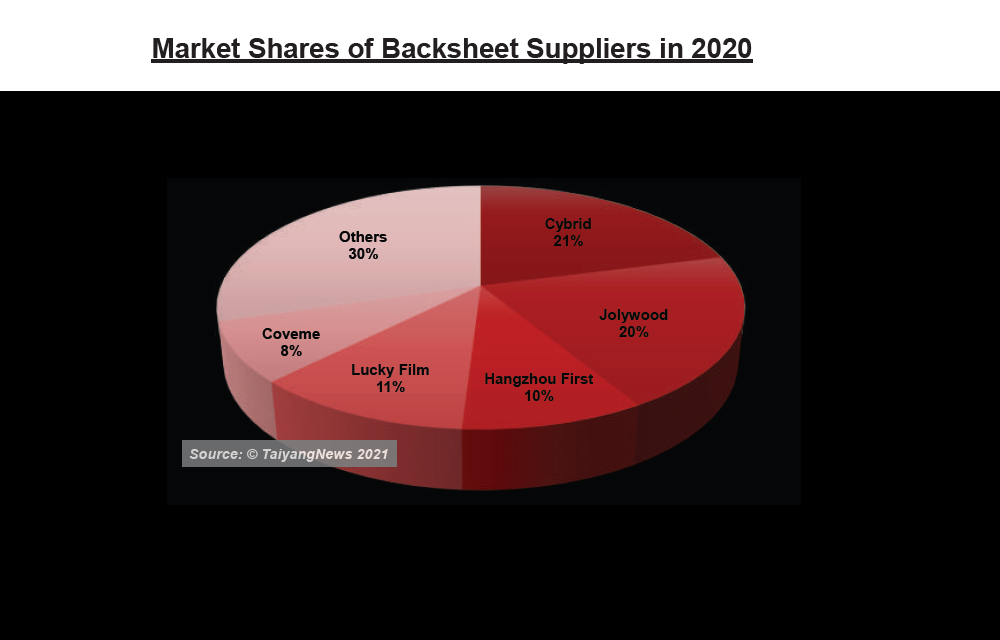

- Leading backsheets manufacturers cybrid and Jolywood share majority of backsheet market with 21% and 20% market share, respectively.

- While PVDF based backsheets led the market in 2020, the high prices of resin is giving way to other materiels, which is also influencing the leading positions

- In 2020 Cybird’s main product was KPf, Jolywod and Hangzhou First mainly promoted CPC, Lucky Film shipments account equal share for Tedlar and PVDF based backsheets and Coveme as usual remained the key promoter of PET-based backsheets.

- Borealis and Endurans are promoting coextruded all-PP backsheet at component level and final backsheet, respectively

In our recent market survey on backsheets and encapsulation we have also looked at shipments of the top backsheet producers. In 2020, Cybrid led the pack in finished backsheet product shipments, as it has since 2015. The company shipped 132 million m2, according to Cybrid. Supporting such a high level of shipments is its installed production capacity of 18 million m2 per month. Its best-selling product, KPf configuration, is the main driver behind Cybrid’s rule at the top for 6 consecutive years. This backsheet configuration is based on PVDF as the outer film, while the Chinese company also does honor special requests to supply the same configuration with Arkema’s Kynar.

Jolywood, the second largest global backsheet supplier in 2020, missed the top spot marginally. The company shipped 129 million m2, and its production capacity of about 200 million m2 per year also places it second in the race. However, as per data for H1/2021, the company has already surpassed Cybrid in terms of shipments. Jolywood had shipped 70 million m2 by the end of H1/2021, 10 million m2 more than the former leader, according to Jolywood.

The reason for Jolywood gaining market share in H1/2021 is the backsheet structure — to be precise, PVDF resin prices more than tripled during this period. This humongous increase in the price of PVDF meant a strong cost increase rise for Cybrid’s key product based on the KPf structure. Jolywood, on the other hand, has been mainly promoting its double-sided coatings based backsheet, which gained demand. Jolywood’s Marketing Director, Chad Yuan believes the share of PVDF containing films is expected to drop from over 50% last year to 35-40% in 2021.

Another leading manufacturer, Lucky Group, sold 72 million m2, or close to 15 GW, of backsheets in 2020. The company is an important laminator for DuPont’s Tedlar-based backsheet and focuses equally on PVDF, each contributing about half of its total shipments. Lucky Film was planning to increase its shipments to 90 million m2 in 2021, or about 20 GW, and has a total backsheet production capacity of 11 million m2 or 2.5 GW per month.

Hangzhou First, the global market leader in the module encapsulation business, shipped 60 million m2 or about 12 GW of backsheets in 2020, about 95% of its 13 GW production capacity. “We are mainly limited by our capacity,” the company said. Hangzhou First has a market share of 8 to 10%, and supplies backsheets with double-side coatings as well as laminated films using PVDF.

For Coveme, the pioneer in PET-based backsheets, the market is currently very good. The shipping quantities from both the production houses of the company, in Italy and China, have increased, according to its COO Monica Manara, who underscored that the cost increase in raw materials and logistics has led to a general increase in costs and sales prices. The Italian company shipped about 50 million m2 in 2020 and expects to increase the sales volume by 10 to 15% in 2021. Of these, PET-based backsheets account for the lion’s share at 80 to 85%. Coveme has a total production capacity of 8 million m2 per month. While PPE is still its main product, the company is also supplying backsheets using Tedlar and PVDF as the outer layer, especially to those manufacturers who insist on fluoropolymer products. The company has developed technologies not only for inner coatings, but special coatings that make the polymer surface scratch and abrasion resistant, aimed at replacing the front glass with a polymer based front cover.

Already active in the encapsulant and backsheet space through Tomark Worthen, US based Worthen Industries has now acquired Dutch chemical company Royal DSM’s backsheets business and renamed it Endurans Solar, which reminds of DSM’s erstwhile backsheet product series named Endurance. Endurans is expected to benefit from the combined experience from both ends — 120 years from DSM and 150 from Worthen. Having access to production capacity in the US on top of the existing facilities in Belgium, The Netherlands and China, “This makes us a truly global player,” said Annet Hoek, global communication and branding lead. The company offers two product streams. The Endurans HP is a coextruded all-PP based all-purpose backsheet suitable for various module types and applications. The product is making good inroads into the Chinese and Indian markets; becoming active in Europe and the USA would be part of the next phase of action, according to Hoek. The company also has a conductive backsheet specially designed for back-contact solar cells called Endurans CB. Hoek is also optimistic about the prospects of this specialty product, especially after proving the business case through the partnership with Silfab Solar. Endurans sees high scope for this product for use in modules not only for the residential segment, but also other high-end applications such as vehicle-integrated and building-integrated PV. While not disclosing annual shipments, Hoek underscored that more than 15 million modules will feature Endurans backsheet by early 2021. The company doubled its capacity last year and has plans do it again in 2022, but did not provide exact capacity details.

Shingi Urja, in cooperation with Borealis, is progressing path of developing all-Polyolefin based backsheet, but waiting for the market acceptance for this new backsheet structure to kickstart the commercial activities. As of now Shingi Urja is mainly promoting the PET based backsheets, the mainstream configuration in the Indian market, while has also finished the certification procedures with its PVDF based 1500V configuration. The company is currently ramping up its production facility to 5 GW capacity. It also has in-house know-how expertise and manufacturing technology to produce coatings based backsheets.

The Text is an excerpt with few updates from TaiyangNews’ recent Market Survey on Backsheet and Encapsulation Materials, which can be downloaded for free, clicking the blue button below.

Source from Taiyang News