You’ve done it. You’ve invested the time and money and have launched the next billion-dollar product. Or, so you thought. Sadly, in your eagerness to become the next Bill Gates, your product is not the mother lode you hoped for. The market has too few customers to support your business and you are on the verge of closing down. Unfortunately, this outcome is a common reality. Only 5% of new products released each year succeed.

There is no definitive way to ensure your product launch succeeds. Rushing the process only increases the chances of failing, particularly if your business deals in cutting edge technology or a brand new offering.

Even tech powerhouse Google has made mistakes and jumped the gun, entering markets in which it could not succeed. Google Glasswas a revolutionary development in wearable technology, combining augmented reality with eyewear to display information (such as maps, a calendar and an internet browser) in the user’s field of vision. Unfortunately, the device was a failure, with most consumers left wondering how it would benefit them. However, the device was not intended for the ordinary consumer. Google’s failure to define, validate and target the correct market meant it never reached the intended tech-reliant consumers.

Google Glass is just one instance where a company has failed to understand and address the needs of its core target market. As a result, not enough customers in the wearable device market could support the continuation of Google Glass. However, while Google could bounce back from this unsuccessful product launch, not all companies have the net worth or product scope to do this. In particular, a startup’s viability hinges on few product developments, making them highly vulnerable to customer reaction.

Great products do not sell themselves. A sizeable or affluent target market with unmet needs must exist for your product to satisfy. Market sizing will help take away the guesswork, enabling you to make sound and well-informed decisions regarding your investment.

What is Market Sizing?

Market sizing is the process of estimating the number of potential buyers of your product or users of your service. This process draws on data from both primary and secondary sources to estimate your market size. This gathered data will indicate your market’s potential and the value it will bring to your businesses, in terms of

- annual revenue, or

- the number of sales/units sold.

Do not be duped by the name; market sizing is far more than just estimating a market’s size – it’s about estimating how much of a market you can win. One of the biggest pitfalls for keen startups and entrepreneurs is overestimating their market size.

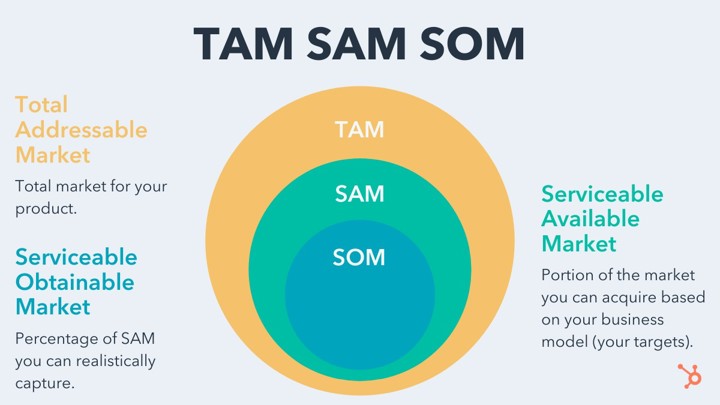

Think of market sizing as a funnel: total addressable market (TAM) at the top, serviceable addressable market (SAM) in the middle, and serviceable obtainable market (SOM) at the bottom. The TAM is the overall market for your product or service, and is generally calculated in annual revenue or unit sales. The SAM is a subsection of the TAM that you could theoretically acquire with your product. However, unless you are a monopolistic business, the chances of you capturing the SAM are slim. The SOM is a percentage of the SAM and refers to the group of customers that you can realistically reap or persuade to use your product or service.

Compare market sizing to fishing: the TAM is the size of the pond you are fishing in; the SAM is the number of fish that exist in the pond; and the SOM is the number of fish you are likely to catch.

Market share estimations are a common chat on business reality television series Shark Tank – but place too much relevance on your TAM and the ‘Sharks’ will attack. The Sharks know, you will not acquire every customer in a market. You must analyse the realistic market size available to you, or you risk a failure like Google Glass.

The TAM for Google Glass is the total annual revenue of the wearable device industry. This industry develops and sells devices that the user can wear, situating smart glasses among technology like smart watches. However, Google Glass’s varied functions also put it in limbo among numerous other industries, such as the Retail Market for Smartphones industry. This limbo caused a strained target market, extending across multiple customer segments.

But which specific customer group’s needs did the glasses address? Was it wanting an everyday fashionable device, or applying specific practical functions, such as in surgical settings? In actuality, the SOM (the number of consumers who benefited from wearing the glasses) was low, and mostly included scientists, photographers and artists. While the technology was impressive, many tech enthusiasts couldn’t look past the unappealing price and design, instead opting for mainstay devices like smartphones.

Why is market sizing important?

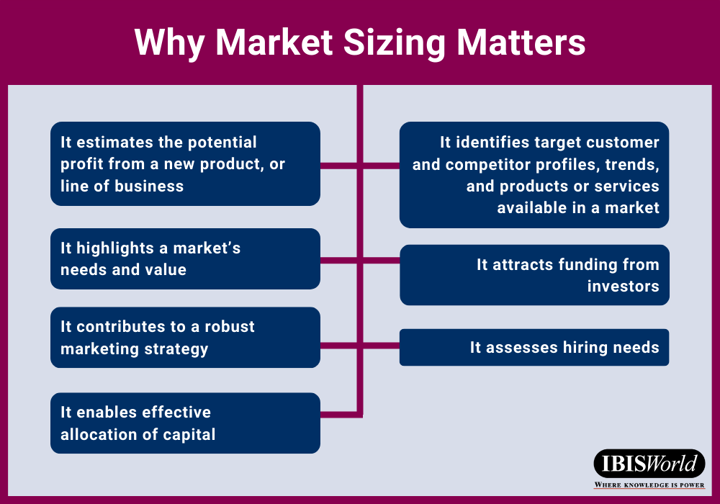

Market sizing is an invaluable exercise for all businesses, including early bloomers aiming to launch into a particular market, and established players looking to expand into new fields. Market sizing is a metric that will provide a snapshot of the market share your business can capture. You can use market sizing to determine your potential power over your market and competitors. This practice is especially beneficial for startup businesses and early-stage entrepreneurs, as they typically lack experience and resources.

Market sizing will provide answers to your burning questions, such as:

- Will your product/service appeal to a market?

- Is the market large enough to interest you?

- Is the market boding well or poorly?

- Is the market profitable enough to interest you?

When to conduct market sizing

Estimating market size should be the first step in developing any business plan. This step is where revenue goals can be outlined. There are two key instances that require you to estimate market potential:

1. Launching a new product or service

Sell the experience, not the product. When launching a new product or service, ensure it appeals to and solves a problem for the buyer. You must analyse your intended buyer and their needs, and calculate how many buyers you can capture to successfully launch a new offering.

Global tech giant Apple Inc. consistently delivers innovation excellence. Apple has mastered effectively estimating realistic interest in its products or services, largely through customer surveys. The company is therefore extremely knowledgeable about what products are hits and what products are failures among its customers. For instance, Apple launched the iPad to satisfy consumer demand for mobile computing. The product was a huge success as it both fulfilled a consumer need and had few similarities to other products in the market.

2. Expanding into a new market

Test the waters before jumping in. As your company grows, so will its offerings. This growth may have you sailing new courses with a whole new crew of consumers. Here, you can leverage market sizing exercises to better understand the customers, competitors, and the overall market environment you are setting sail for.

Multinational soft drink manufacturer Coca-Cola credits its success to organic growth and large-scale acquisitions in both developing and emerging markets. In pursuing acquisitions, Coca-Cola have thoroughly measured the potential value of its investments. For instance, in 2007, Coca-Cola acquired Energy Brands (or Glacéau) for US$4.1 billion – a steep price for businesses with $350 million in annual sales. Glacéau appealed to Coca-Cola because of its position in the nutrient-enhanced water market, with health-consciousness becoming increasingly relevant to consumers. Through market sizing exercises, Coca-Cola projected that Glacéau would constitute a significant portion of the beverage manufacturing industry’s growth over the two years through 2010 – and they hit the nail on the head.

How to conduct market sizing

Are you realising the opportunities to define your target market size, but unsure how to go about it? Consider the following three steps:

Step 1: Determine what questions you need to ask

Market sizing questions (or guesstimate questions) ask you to estimate the size or value of a market for specific factor. This ‘factor’ could be the number of customers willing to invest in your product or service, and the total sales and units sold.

Examples of market sizing questions:

- What is the market size for catering services in Australia?

- How many cinemas are in Australia?

- How many Australians require retirement village accommodation?

Step 2: Develop a market size framework

Two frameworks are commonly used to answer your market sizing questions: top-down and bottom-up.

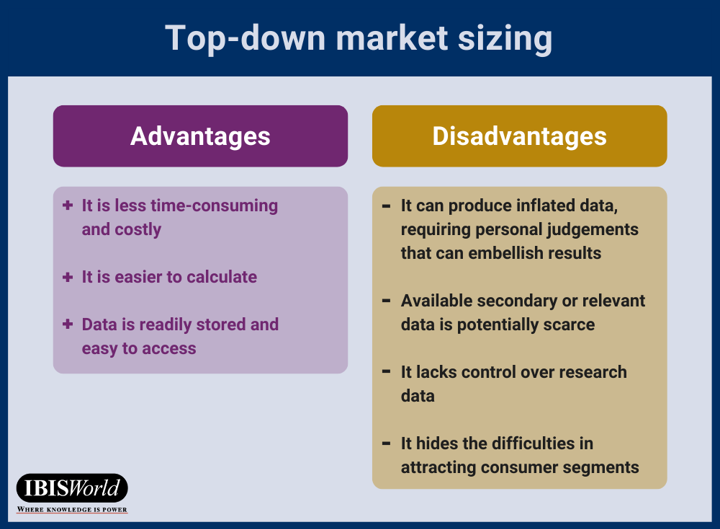

Top-down market sizing

The top-down approach begins with looking at your TAM and ends with your SOM: a shrunken down target market that you could realistically capture. This approach is conducted using secondary research, including reports and studies released by government departments and other public entities. This approach is therefore best suited to large, established markets, where an abundance of data and analysis already exists.

You may stumble across published estimations of your market, providing you with your current TAM. From here, assumptions can be made to estimate your SAM and SOM.

Top-down market sizing example:

Question: What is the SOM for detergent distributors in Australia?

You have formulated the perfect cleaning detergent and want to unveil it. After extensive online research, you find a source saying that the Cleaning and Maintenance Supplies Distributors industry, (your TAM) has grown over the past five years. The industry currently generates annual revenue of $1.6 billion. Through some additional research, you detect that chemical-based cleaning products account for approximately 30% of this revenue. As this product segment also includes disinfectants, soaps and soap-based products, you estimate detergents account for a quarter of this product share, that is 7.5% of the industry. Therefore, the revenue from your estimated SOM is:

Does this all seem too optimistic? The top-down approach has certain drawbacks, as it can omit critical assumptions and other market factors. For example, the COVID-19 pandemic led to a surge in demand for cleaning products, contributing to a proportionately higher TAM than in a period not affected by pandemic conditions. In this case, the earlier calculation, which was based on revenue in a COVID-19 year, may have over overestimated the annual SOM.

Another lapse in this calculation is that it has disregarded the impact of green consumers, who have driven up demand for green cleaning products. Green products typically carry premium prices, which contributes to a stronger TAM. If your detergent was inexpensive and generic, not marketed at green consumers, the top-down approach would be an exaggerated analysis. Your potential earnings would not match the above calculation.

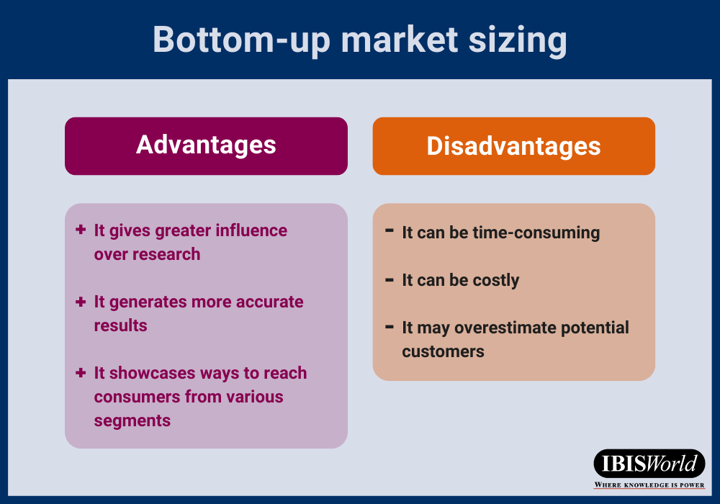

Bottom-up market sizing

The bottom-up approach begins with your products and the basic units of your business, such as your customers and average price, and estimates how much you could scale them up. The end value is your market size. While this method is more complicated than the top-down approach, it is a more accurate and reliable method for smaller markets. The bottom-up approach also requires an extra step before delving into research: distinguishing your target market.

Bottom-up market sizing example:

Question: What is the potential annual revenue for wearable medical monitors?

a. Distinguish your target market:

Put it on paper. It’s important to explicitly spell out the type of consumer your product or service is most suited to. Your offering must fulfill or resolve this consumer’s needs or problems. Otherwise, like Google Glass, you may be left with an ingenious idea, but no interested buyer. Make sure you can also reach the consumers you are chasing.

You can use market segmentation strategies to divide your potential market into approachable groups, based on factors like geography, demographics or interests. Choose which of these groups you want to focus on – you will only calculate the size of your chosen groups. External sources can assist in defining and calculating your target market, including

- data providers,

- civil society organisations,

- state development offices,

- regulatory bodies or government agencies that handle business and commerce.

For example, you have created a wearable monitoring device that medical practitioners can provide for their patients with chronic illnesses. After searching online, you determined

- there are at least 104,000 medical practitioners in Australia (according to the Australian Government’s Department of Health); and

- almost 50% of Australians suffer from at least one chronic condition (according to the Australian Bureau of Statistics).

From here, you source a list of medical practitioners in Australia and the most common chronic condition groups for all Australians. This list shows both your B2B demand (i.e., the practitioners you sell to) and downstream demand (i.e., the patients of practitioners).

b. Determine the interest in your product or service

You’ve distinguished your target market. Unfortunately, not every customer in this market will be ready to buy. You can render down your market and determine your realistic interest using various market research methods, including:

- competitor analysis

- individual interviews

- focus groups

- surveys

First, analyse the success or failures of your competitors – this can provide a safe estimate of your potential market size. Moreover, it shows what market share is untapped and left for you to take. For example, global powerhouses Facebook, Twitter and LinkedIn make up almost 90% of revenue in the Social Network Sites industry. Such high market share concentration makes it difficult for new entrants to gain ground, as most users are loyal to these incumbent brands.

The next step is to use primary research tools (such as focus groups, interviews and surveys). Ask open-ended questions or offer up your product to large respondent populations to try. Doing so will hone your analysis, and get down to the nitty-gritty of how your target market ranks your product or service.

Possible questions to ask your sample population:

- How will your patients benefit from a wearable monitoring device?

- How useful would this device be to your medical services?

- What functions would this device require to support your patients?

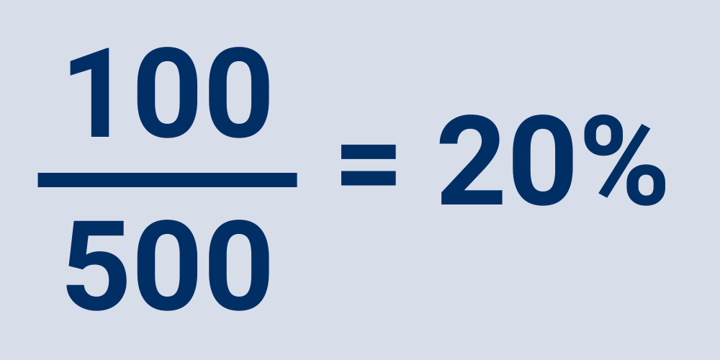

For example, in one month, you conduct 500 phone calls with randomly chosen medical practitioners You explain the concept and the benefits of your wearable monitors for their chronically-ill patients. You also phone end users to understand how a monitoring device could assist them. During the calls, 100 practitioners express a strong interest in your device, and eagerness to buy on its launch. Therefore, your total interest is:

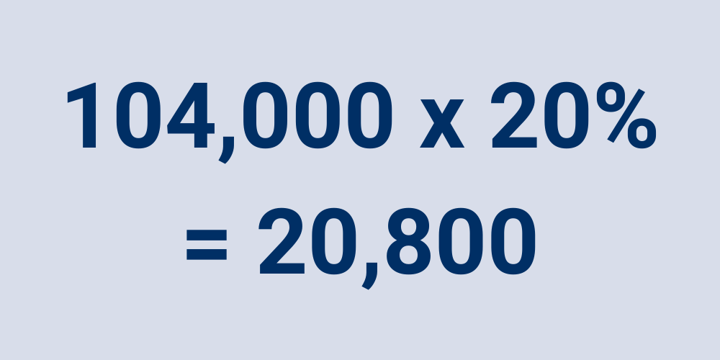

After deriving your total interest as a percentage, use your target market (104,000 Australian medical practitioners) to calculate your market of interest in numerical terms:

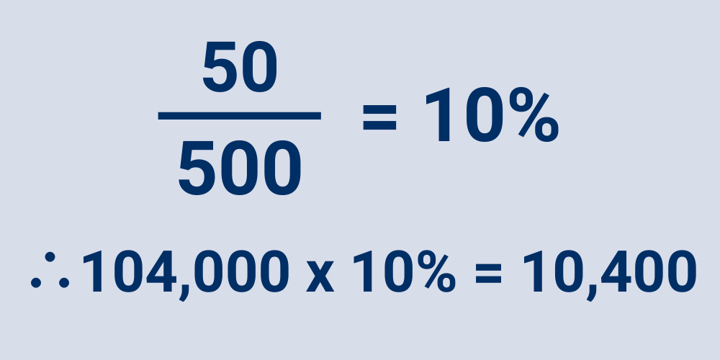

Take feedback with caution and avoid using exaggerated or vague claims about your product or service. A reasonable consumer will consider factors such as budgets, economic conditions and priorities when making a purchase. However, the excitement of an interview may overshadow these factors. For example, you assume practitioners at small-scale medical clinics (50 out of the 500 practitioners sampled) will not have the capital or client numbers to require your device. You therefore decide to remove them from your calculations, despite their interest to buy. Your new target market is:

For further help in conducting primary research, follow one of the links below:

c. Calculate potential return:

You’ve completed all the appropriate steps to calculating a realistic rate of return. This crucial calculation will determine whether or not your investment is worth your time and money.

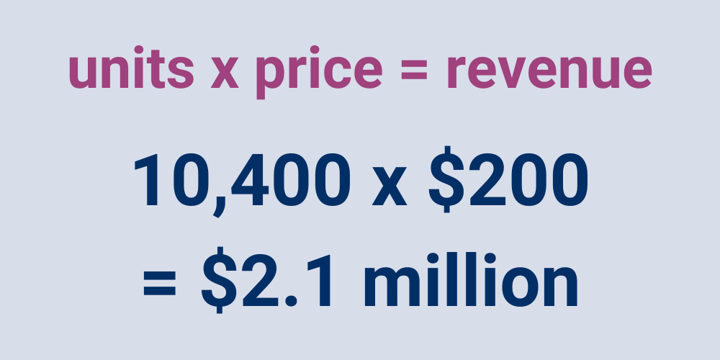

For example, you’ve determined that 10,400 medical practitioners might invest in your device, which costs $200. If every medical practitioner buys at least one device, your expected return is:

Based on the phone interviews, you determine every practitioner would need at least three monitors on hand. Therefore, your new anticipated return is:

Say you have already estimated that the development, testing and marketing of the monitors will cost you at least $2 million – your investment is slightly over 20% of potential annual revenues. This investment represents a moderate risk, enticing you to move ahead with the development and deployment of your new device.

The bottom-up analysis still comes with some flaws. Overestimation is a very common problem with this approach. Any errors made at the micro level – for example, you guessed 50 consumers would purchase your product, but in reality, only 30 would – would be compounded as you scale to macro level.

Additionally, say that 10 of the practitioners you phoned and agreed to purchase your product all worked in the same clinic. Without further analysis, you may assume this clinic would house 30 monitors, which is realistically unlikely. You must therefore look out for instances of customer surplus in your analysis.

Step 3: Verify your results

No matter the framework you decide to conduct, both have their pitfalls and require additional assumptions to be made. Ensure you triple-check your numbers to account for wider market trends. For instance, in your analysis of the medical devices, you may consider the Federal Government’s aims to increase health sector funding, or projected growth in the number of Australians suffering from chronic illnesses. Additional spending on medical clinics, along with growing downstream demand, is likely to entice more clients to invest in your device.

Takeaways

Despite the excitement and thrills that come with launching a new business offering, remember it is okay to take your time. This is especially true when it comes to gauging your company’s expected market share and revenue. Learn from Google’s mistake, just because you build something does not mean people will buy it. Market sizing is therefore globally considered an imperative marketing exercise by businesses, entrepreneurs and investors.

Source from Ibisworld

Disclaimer: The information set forth above is provided by Ibisworld independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.