Smart pricing in retail leads to greater customer retention and greater profits. Additionally, selecting the right price point is key to building your brand — a core component of the marketing strategy of any business. To learn what pricing is, how to set retail prices effectively, and how to check that your pricing works for your store, read on.

Table of Contents

What is pricing?

How to choose your retail pricing strategy

3 common pricing strategies

Psychology in retail: pricing to appeal to consumers’ minds

How to evaluate your retail pricing strategy

What is pricing?

Pricing is one of the most important merchandising decisions in retail, directly impacting who the customer base is, the level of customer retention, sales, and ultimately profit.

Simply, pricing is assigning a cost to each product. In order to keep a business afloat, the cost of each product must take into consideration the amount spent per product (buying it, shipping it, taxes, etc.) as well as the profit margin desired.

For example, if a business buys a product for $1.05, they must first add all that product’s overheads to the cost before they can price for profit. Once that has been calculated, the real cost of that product may be $1.50, for example. Then, the pricing really begins.

Any good businessperson knows that pricing is not as simple as choosing a high retail price in order to gain maximum profit. Pricing is very nuanced. There are two main factors to consider when pricing:

Pricing low

It is common sense that if you price too low, you may go bankrupt. Additionally, if you price too low, your products may be considered bad quality and cheap. However, pricing low can also have its advantages — in the right product categories, this low cost can encourage a huge volume of sales, meaning that although the profit margin is low, the overall profit is very high.

Pricing high

Again, it is common sense that if you price too high, you may lose out to competition. However, there is also the aspect where if you price higher, your products may be seen as being of a higher quality and class — we only need to look at high fashion brands to see proof of that. To get this pricing right, a business must develop a pricing strategy that works for its business goals.

For example, a more luxury brand that wants to attract high paying customers may use a high profit margin that generates lower but more meaningful sales — thereby keeping its customers and products exclusive, but still accumulating large profits.

Pricing strategies vary from store to store, depending on what they are selling, where they are selling it, and who they are selling to.

How to choose your retail pricing strategy

Before retailers and business owners choose which pricing strategy suits their retail store most, it is paramount that they understand a few basic facts about their customers, products, and the market share and profit margins they are looking for.

Understanding costs

The product cost is not simply the cost listed when it is bought at the wholesale price. Product cost is every cent that has been spent on that product by the business from point of purchase or creation to point of sale. This includes sourcing, material, labor, shipping, quality controls, packaging design and the packaging itself, the cost to store and stack it, the wages of the retailers who sell it, advertising the product, the taxes involved (such as VAT), and more.

Be sure to add your product costs to your wholesale costs before adding your profit margin to create your final selling price, or you may incur serious losses for your business.

Defining the commercial objective and identifying customers

This aspect is where a business owner has to decide what their brand is going to look like. Are they looking to be a luxury and exclusive retailer, like Gucci or Chanel, that has higher selling prices and high-profit margins but lower sales? Are they looking to be a budget retailer, like Primark or Forever 21, that caters to those on a lower income — creating high volume sales on a lower profit margin? Or are they looking to be somewhere in between, like H&M or Mango?

Defining a commercial objective and identifying the customer base is essential to building customer loyalty and thus customer retention. So, prior to pricing products, be sure that you understand your marketing strategy and then follow the marketing funnel for the best results.

Finding the value proposition

All businesses have competitors, so to stand out a business owner must be sure to know and promote their value proposition or unique selling points (USPs). This affects item pricing too, as a business may want to address issues such as there being no way to purchase quality at an affordable price in their area. Alternatively, a business may find that retailers in the area are all budget and therefore its value proposition is to offer upmarket products for those looking to add a touch of class or high fashion to their lives.

3 common pricing strategies

Markup pricing strategy

This pricing strategy is the simplest, involving only the addition of a fixed markup or percentage to the total cost of a product. This requires little research and is ideal for most small businesses that are starting out. However, if a retail business is looking for real growth then this strategy can be too simple, resulting in the loss of great profit-turning opportunities.

Markup pricing example

An example of markup pricing would be to take the cost of a book (including all the costs discussed, not just the wholesale cost) and add a % profit margin on top. So, if the book costs $3 and the business owner adds a fixed 10% margin on top, then the selling price will be around $3.30.

Competitive pricing strategy

This pricing strategy is slightly more complex but can result in higher profit margins and a better market share for the business.

What is competitive pricing

Competitive pricing means that the retailer will analyze its competition and try to beat out the competition by offering lower prices. This method can result in higher profits thanks to increased sales and a larger return customer base. However, it can also be unsustainable for small businesses that go up against larger companies with more negotiating power to lower product procurement costs.

On the bright side for smaller companies, however, larger companies usually have higher operating costs, meaning that competitive pricing can still be an effective way for small businesses to increase profits. Additionally, as pricing lower means lower margin, it is necessary to maintain the higher sales volume to keep profits high.

Example of competitive pricing

An example of competitive pricing would be to check a competitor’s price for a same item that exists in your store and to then price below them. So, if your competitor prices a basic T-shirt at $10, then you might price it at $9.

Penetration pricing strategy

Penetration pricing is a fast way to insert a brand into a customer’s mind, encourage customers to shop at your store quickly, and get rid of old stock.

This is usually achieved through promotions and sales to increase customer awareness of your brand and increase footfall. If promotions are made too often, however, customers may feel that the business offers “budget” or “low quality” goods. Additionally, it can mean customers wait for the next promotion as opposed to buying your products at the usual selling price — so be sure to use this tactic sparingly.

Promotional sales work well with cross-selling to boost sales and profit — as although promotions do not create revenue, the increased number of customers will likely buy both a promotional product and a full-price product, thereby increasing awareness and profit simultaneously.

Example of penetration pricing

An example of penetration pricing involves a new retailer that opens its doors to the public and needs to find a way to get its name out there. To do this, they advertise that they are running a limited-time opening week promotion, with discounts of up to 50%.

Psychology in retail: pricing to appeal to consumers’ minds

Pricing is highly psychological for consumers — hence why so many prices often have an additional $0.99 as opposed to the full dollar. With this in mind, many businesses tailor their pricing strategies with psychological pricing. Two of these methods are price anchoring and decoy pricing.

What is price anchoring?

Price anchoring refers to the “anchor” or piece of information that has the most weight on the customer. For example, this could be the price, or whether something is deemed a good deal.

To aid sales conversion using a price anchoring strategy, a business will often use tiered pricing. For example, if a business offers a product at $600 but then offers another similar product for a little less (say at $499), then the customer is more likely to buy the second option — as the price anchor of the second is being compared to the more expensive first.

Offering tiered pricing is a great way to psychologically direct the customer to the selling point you would like them to accept.

What is decoy pricing?

Another psychological retail pricing strategy is known as decoy pricing. This pricing strategy involves the use of three price points, whereby the first is nearly as good as the other two, but missing one core component — thereby making the higher prices look more attractive.

Decoy pricing example

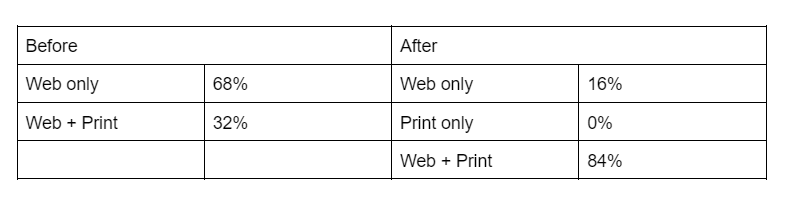

A key example of decoy pricing was used by the Economist magazine.

The magazine initially offered two price points: a “web only” option for $59 a year and a “web and print” option for $125 a year. With this initial offering, 68% of customers opted for “web only,” with only 32% opting for the higher price point. Then, the Economist inserted a third option: “print only” for $125 a year.

Although this third option could be seen as useless, the reality was that it made all the difference. When looked at in a list, the web and print option suddenly seems like a great deal — as you are no longer comparing it to the economical “web only” deal, but are in fact paying the same as “print only” while getting both! The results were that 84% of customers opted for “web and print” and only 16% opted for “web only.”

How to evaluate your retail pricing strategy

Pricing strategies can and should evolve as customer data is gathered – customers may have begun to go elsewhere due to dissatisfaction with prices, competitors may have brought down their prices, etc. To effectively assess how well your pricing strategy is working, retailers should follow a few simple steps:

Sales volume, customer conversion, and retention

If your sales volume, or customer conversion and retention levels are decreasing, ask yourself why.

- Are you losing out to competitors? If so, perhaps it is time to try some competitive pricing options.

- Has your product quality or product selection decreased? Listen to your customers and conduct surveys. Perhaps it is time to use some penetrative pricing to liven things up and then revitalize your store by bringing some newer and more trending items in.

Margins and order size

It is key for any large or small business to keep an eye on profit margin and order size. If this is not done properly, then you may find you are losing money or simply not making the revenue that you could be.

- Are your margins healthy? Check your retail strategy and competitors to see if you can increase your prices.

- What does your order size look like? If some products are selling in high volumes, perhaps it is time to increase your minimum order quantity (MOQ) with your supplier and negotiate a better price. If they are selling in low volumes, then find out why and address it.

- Stuck stock is lost revenue and, in this case, it may be better to lower the price and sell it at a lower margin to make space for a new trending option (penetrative pricing).

Working capital turnover

To find out how healthy your business’ finances are and how well your business is at sustaining itself financially, it is important to consult the working capital turnover ratio of your business. This ratio measures the relationship between the money used to run the company and the revenue stream that the company is generating, thereby illustrating how much capital is available to be put toward operations once all obligations have been met.

To do this, you must follow two steps:

- Work out the capital turnover: Take away the total costs from the total assets.

Total assets – total liabilities = capital turnover

- Work out the capital turnover ratio: Divide the company’s net annual assets by the average working capital.

Net annual sales / average working capital = capital turnover ratio

If your working capital turnover ratio is high, it indicates a healthy ratio and efficient cost management. If your working capital turnover ratio is low, however, it could mean your company is not investing wisely and may not have enough capital to support itself. If a company finds itself in this position, it would be wise to reassess the pricing strategy to increase the speed with which it can clear its inventory — as this will then allow the business to reinvest the cash into the next cycle.

Conclusion for retail pricing

Pricing is a core component of any business strategy and understanding how to set retail prices should not be taken lightly. It not only dictates the viability of your retail business but also shapes your brand image and customer base. To make sure your retail business is pricing effectively, remember to employ tried and tested pricing strategies and to evaluate them regularly.

Additionally, never forget to source at the best price possible, as this will help you increase your profit margin, and thus total revenue. This is best achieved by sourcing on e-commerce platforms that offer a large array of wholesale suppliers, such as on Alibaba.com.