What is industry analysis?

Industry analysis is a market assessment tool that can help you to understand a company’s operations within the context of others like it. Typically, the goal of industry analysis is to understand how you or your client can compete with the major players or market leaderswithin an industry. However, goals can be varied. Industry analysis can also help you look at growth opportunities, external risks or technological changes that are occurring within an industry.

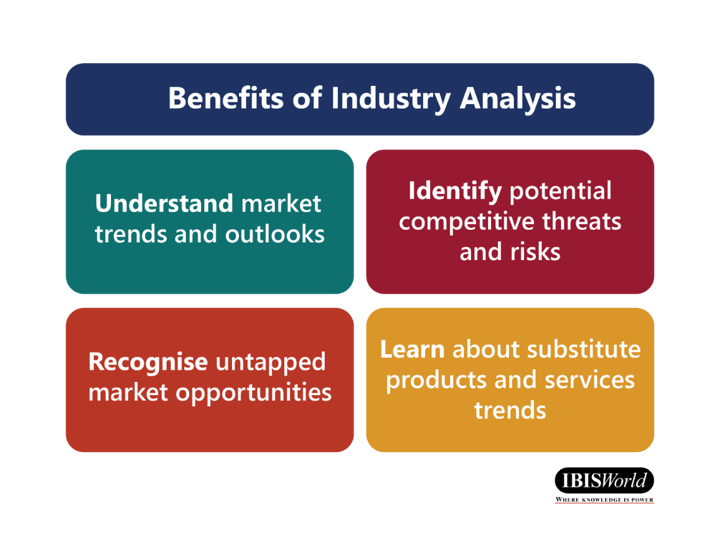

What can you achieve through industry analysis?

At a high level, it can help you to develop and refine your company’s business strategies according to market conditions, not just its internal operations. Industry analysis is a crucial component of most business activities, from sales to marketing and strategy, procurement, M&A and product development. Within sales, and marketing and strategy, conducting industry analysis saves time in qualifying opportunities, while also helping to position salespeople as experts and boost their credibility. It enables strategic refinement of your company’s target markets, which helps generate revenue more effectively. It also assists your business in product development, identifying growing markets and emerging trends, allowing your company to capitalise on changing industry behaviour and stay ahead of the curve.

Without the added context of industry analysis, you risk seeing only part of the picture and missing critical details of an opportunity or risk. As industries are continually evolving, past industry analysis can become outdated extremely quickly, meaning regular examination of the environment you operate in is imperative to your success.

Why is industry analysis important?

Businesses need to understand their operations within the context of comparable businesses and their environment. So, whether you’re reviewing your own business or your client’s, remember that no company operates in isolation. To be successful, businesses need to understand not only their own operations, but those of the businesses they are competing with. The value of knowing your market cannot be understated.

Types of industry analysis

A range of industry analysis frameworks can be employed to contextualise a company’s operations, including:

- Competitive analysis (Porter’s Five Forces)

- Strategic analysis (SWOT analysis)

- Broad factor analysis (PESTELE analysis)

Let’s examine each of these frameworks in greater detail.

Porter’s Five Forces

Michael Porter’s model for industry analysis outlines five key forces that help provide an accurate view of an industry. Developed at Harvard Business School in 1979, the model remains among the most famous and well-regarded for analysing an industry’s conditions.

The five forces covered by the model are:

- Threat of potential new entrants

A company’s competitiveness can be affected by how easily a new business can enter the same industry. An industry where the large incumbent players hold significant market power typically means that it is difficult for new businesses to enter. Conversely, when an industry is highly fragmented without companies that hold large market share, it is generally easier for new businesses to enter the industry. More entrants means more potential competitors for your business.

Questions to consider:

– What are the barriers to entry of your industry?

– How have you prepared yourself for new entrants?

- Threat of substitute goods/services

This threat refers to how easily your customers can find an alternative product/service that would equally meet their needs. If your product or service is highly specialised or differentiated, you should be relatively insulated from the threat of substitutes. However, if you sell something that is easily substituted, such as food, it can be more difficult to retain customers.

Questions to consider:

– How easily can your products and/or services be substituted?

– How can you protect your business from substitute threats?

- Rivalry among existing competitors

Existing competitors usually provide the greatest source of competition, which provides the basis of internal competition. How competition is measured within an industry depends on the life cycle maturity of the industry. Industries can either be growing, mature or declining. Growing industries will often display rapid new product development to compete, whereas mature industries will show strong branding and marketing tactics. Declining industries compete most strongly on price, with firms lowering prices as a competitive advantage.

Questions to consider:

– How many competitors do you have?

– How strong are your competitors?

– What forms of competition are they displaying?

- Bargaining power of suppliers

This refers to the strength of a company’s suppliers, and is mainly measured through their ability to raise prices. If a supplier sells a unique offering that can’t be easily found elsewhere or substituted, then it has more power to influence price. On the other hand, suppliers that are less able to differentiate their offering do not have this power since they can be easily replaced.

Questions to consider:

– How many suppliers do you have?

– More importantly, how unique are the goods/services that they provide you?

- Bargaining power of buyers

Finally, the bargaining power of your buyers or customers is influenced by the relative number of buyers to suppliers in an industry. If you sell your goods or services to a small number of large customers, their ability to influence the price paid is greater. However, selling to a large number of customers, especially if they are smaller, reduces their bargaining power and means they are less able to easily switch suppliers.

Questions to consider:

– Does your market have buyer power?

– How can you insulate yourself against customers changing suppliers?

Below is an example of how Porter’s Five Forces could be applied to a particular industry.

Industry Analysis Example:

Wireless Telecommunications Carriers in Australia

- Threat of potential new entrants

Market share concentration among Telstra, Optus and TPG is often over 90%. Therefore, their significant market power creates high barriers to entry for the industry, limiting the threat of potential new entrants. There is some scope for competitors to emerge through licencing and the use of existing network infrastructure.

- Threat of substitute goods/services

This industry does not have any direct or perfect substitutes for its goods and services. However, some aspects of the activities carried out by mobile phones can be done elsewhere. For example, communication over the internet, such as through Zoom or Microsoft Teams, can partially fulfill the role of mobile phones. Nevertheless, mobile phones remain an essential component to modern communications.

- Rivalry among existing competitors

This industry is mature. Competition among the incumbent major players largely relates to strong marketing and promotion activities, as each strives to maximise brand awareness. Companies also compete based on price, as many consumers seek the lowest price due to the recurrent nature of mobile phone costs.

- Bargaining power of suppliers

Industries that supply to Wireless Telecommunications Carriers mainly display low market share concentration or regulation on pricing due to the essential nature of telecommunications. As a result, the bargaining power of suppliers is relatively low – benefiting the industry’s purchasing position.

- Bargaining power of buyers

The industry’s ultimate downstream buyers are consumers. Typically, markets as large and fragmented as general consumers do not exert buyer power, since the loss of one individual customer does not greatly impact a wireless telecommunications business’s revenue. However, intense price competition among the major players indirectly causes the collective buying power of price-conscious consumers to influence prices received by the industry.

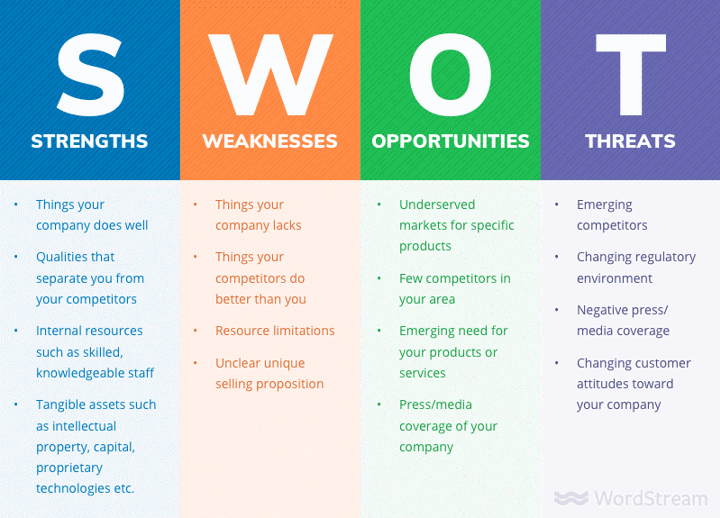

SWOT analysis

SWOT analysis looks at the Strengths, Weaknesses, Opportunities and Threats, and is probably the most broadly used framework for analysing an industry. It is particularly useful for summarising an industry’s conditions and their implications for your or your client’s business. It can also help to provide context relative to the SWOT conditions of other industries.

As outlined in the above graphic, SWOT analysis covers four areas:

- Strengths

Look at what your industry already does well. This can include understanding aspects that differentiate your industry from others, or learning how to gain access to unique resources through your industry.

Questions to consider:

– What are the favourable aspects of your industry that your business or your client’s business can capitalise on?

– How can you leverage your strengths to outperform your competitors within the industry?

- Weaknesses

Think about where your industry lacks resources. Any inherent features where there is potential for shortcoming can be mitigated or managed. It is also useful to think about how your organisation would be perceived by your competitors, and any weaknesses they may try to capitalise on.

Questions to consider:

– Are there any shortcomings within your industry that can be improved?

– If the weaknesses you have identified cannot be improved, how can you mitigate any risks that they may present?

- Opportunities

Consider whether there are untapped areas for your business to grow. Identifying points where a chance exists for your organisation to drive revenue or develop new channels or markets is a crucial habit for growth.

Questions to consider:

– Are there industry trends that you can take advantage of?

– How can these opportunities be quantified?

- Threats

Delve into what threats could be on the horizon. These can be any existing or emerging external factors that may present a risk to your business, such as supply-chain constraints, changing consumer preferences, or technological developments. Anticipating and spotting threats in advance is crucial to retaining a competitive edge.

Questions to consider:

– What type of external threats exist for your industry (PESTELE analysis can help to identify and articulate these threats)?

– How can these threats be managed?

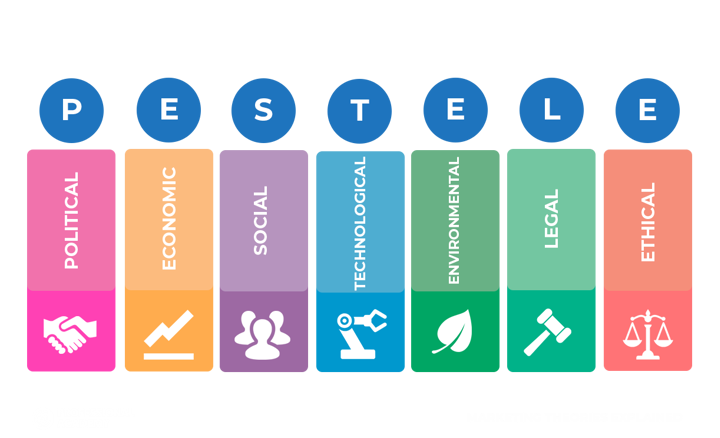

PESTELE analysis

PESTELE stands for Political, Economic, Social, Technological,Environmental, Legal and Ethical. Looking into these factors can help to provide context about an industry’s external environment. PESTELE analysis can complement SWOT analysis well, as together these frameworks provide both internal and external industry analysis. PESTELE analysis can also help to identify external risks and opportunities that are less likely to have been considered using SWOT analysis alone.

Here’s how to approach each factor.

- Political

Think about any upcoming regional or national elections. How might these affect your ability to operate, and what are any relevant regulatory changes that may occur? You should also consider any potential trade or taxation policy changes as part of your analysis of this factor. In terms of assessing risk, consider whether there are any existing policies that your business relies on.

- Economic

Consider the stability of the current local and global economy. How might factors like unemployment, inflation or GDP growth affect demand for your products/services? World events also have the ability to create demand or supply shocks, limiting availability of goods and services and causing swings in prices. Ensuring effective supply chains with longer term price agreements can reduce volatility stemming from economic risks.

- Social

Identify and understand the demographics in your market. Are they changing? This is especially relevant if you solely service a local area. More broadly though, shifts in consumer preferences across wider areas should be kept abreast of. Failing to understand changes in the needs, desires and lifestyles of consumers/markets can cause an organisation to lose its competitive edge.

- Technological

Look into any technological development in your industry. This factor can represent both a strong opportunity or risk. Adopting technology early can provide a significant advantage over competitors. However, failure to adopt technology, or to address threats from technology in competing industries can cause a business to fall behind. What technologies exist that could be leveraged?

- Environmental

Be mindful of how your business has a direct impact on the environment. Or, if not a direct effect, does your business have an indirect one? In an evermore environmentally aware corporate and social world, this factor is increasingly central to an organisations strategy. Developing Corporate Social Responsibility functions and plans to align with net zero targets or Sustainable Development Goals can help to let customers know that you are planning for sustainability.

- Legal

Be mindful of any shifts in the legal environment. Compliance requirements can be fast-moving in certain industries. However, you also need to be aware of the existing legalities of your operating environment. Are there aspects of your business that rely on existing compliance requirements? Could there be risks or opportunities in any upcoming legislative changes?

Now that we’ve examined the different kinds of analysis tools available, let’s wrap up with a step-by-step guide for conducting industry analysis.

How to Conduct Industry Analysis

Here are the five key steps to conducting industry analysis. In conducting your own industry research, you may use one of the analysis frameworks outlined above, if not a combination of the three.

- Conduct background research

To begin, do your background research. Identify what resources are available, where information is lacking, and what your company’s industry looks like. Decide whether you’d like to look from a high level or drill down very specifically. Ensure that you clearly state the aim of your research and what questions you want answered.

- Approach the correct industry

Make sure that you are looking at the correct industry. This step is essential to get right. Using factors like supply chain analysis and competitor analysis will help to make sure you determine the right industry.

- Collect and collate your data

After completing background research, collecting your data will help you to identify key market conditions like sizing and growth prospects. Collate data from within your company, from external researchers and other public company information to provide an in-depth picture of your industry.

- Analyse your findings

Assess what the data you’ve assembled tells you. Does it align with your expectations? What new insights have you derived? Answering these questions will help you to decipher the most valuable and actionable insights from your research thus far.

- Write your analysis

Lastly, summarise your findings. Try to provide some structure to your written report to ensure there are clear results from your research and analysis. For example, have you provided a clear overview of the industry? Have you stated the aim of your research and answered those questions in your analysis? These will help to provide a framework to understand your analysis. Finally, make sure you outline actionable insights to take away from the analysis.

Source from Ibisworld

Disclaimer: The information set forth above is provided by Ibisworld independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.