- Canada has announced various measures to support the clean energy industry under its Budget 2023, as a response to the IRA of the US

- Clean Electricity Investment Tax Credit is expected to cost the country $6.3 billion over 4 years, starting in 2024-25, and an additional $19.4 billion from 2028-29 to 2034-35

- Another important feature is the Clean Technology Investment Tax Credit to be available immediately till 2034

Taking a cue from its neighbor the US, Canada has come out with its own financial and regulatory support package for clean electricity offering a 15% refundable investment tax credit (ITC), and also ‘clear and predictable’ tax credits for clean technology manufacturing under its Budget 2023.

Referring to the Inflation Reduction Act (IRA) of the US as a ‘major challenge to our ability to compete in the industries that will drive Canada’s clean economy’, Canadian Minister of Finance Chrystia Freeland said the $369 billion support under the IRA could stimulate as much as $1.7 trillion of private and public investments in the US clean economy over the next 10 years.

“Canada has all of the fundamentals required to build one of the strongest clean economies in the world. However, without swift action, the sheer scale of US incentives will undermine Canada’s ability to attract the investments needed to establish Canada as a leader in the growing and highly competitive global clean economy,” said Freeland.

It follows the Canadian government proposing incentives for net-zero technologies in November 2022.

Here’s what the Budget 2023 offers for the country’s clean energy market, as summarized by the Canadian Renewable Energy Association (CanREA):

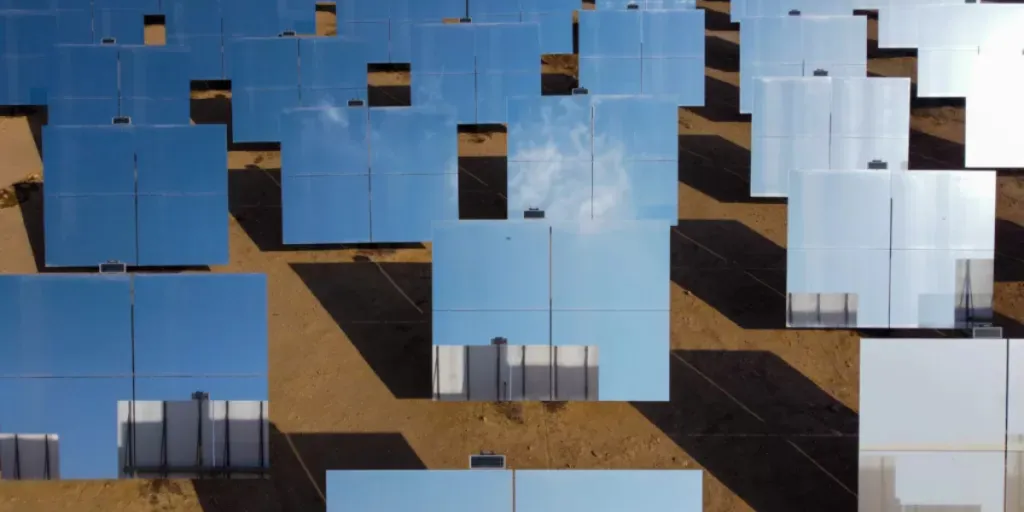

- Under, Clean Technology Investment Tax Credit, there is a refundable 30% ITC to cover capital cost of investments made by taxable entities in wind, solar PV and energy storage technologies, starting from March 28, 2023 to 2034. It will not be available for projects that co-produce oil, gas, or other fossil fuels.

- Refundable 15% tax credit on capital costs of investments made by non-taxable entities as indigenous communities, municipally owned utilities and Crown corporations that make investments in renewable energy, energy storage and inter-provincial transmission and other non-emitting electricity infrastructure under the Clean Electricity Investment Tax Credit. This is expected to cost $6.3 billion over 4 years, starting in 2024-25, and an additional $19.4 billion from 2028-29 to 2034-35.

- A 30% refundable ITC under Clean Manufacturing Investment Tax Credit for investment in machinery and equipment used to manufacture clean technology and extract relevant critical minerals. Renewable energy and energy storage equipment manufacturing, and recycling of critical minerals is also covered under this.

- Refundable 40% ITC for green hydrogen as part of the Clean Hydrogen Investment Tax Credit.

- $3 billion support for Smart Renewables and Electrification Pathways (SREP) program.

- Canadian Infrastructure Bank will invest a minimum of $20 billion to support major clean electricity and clean growth projects.

- By the end of 2023, the government will outline a concrete plan to improve the efficiency of impact assessment and permitting processes for major projects.

CanREA is happy with the government’s move for the industry. CanREA President and CEO Vittoria Bellissimo commented, “Canadian investment tax credits will stabilize investment opportunities, while safeguarding affordability for Canadians. These new incentives will help create good jobs in clean energy and make Canada a leader in the energy transition.”

A climate non-profit Clean Prosperity agrees the Canadian budget is a big boost for clean energy, but believes the country needs to take urgent action on policies like contracts for difference (CfD) if it really wants to systematically level the playing field with the US.

Clean Prosperity’s Executive Director Michael Bernstein said, “The US is like an airline sending everyone straight to first class. Today, Canada upgraded some of its passengers, but it can’t forget about the people still sitting in coach.”

Details of the Budget 2023 are available on the government’s website.

Source from Taiyang News

The information set forth above is provided by Taiyang News independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.