1. Development background: policy-driven industry for energy-saving and efficient development

Currently, according to different working principles, compressors can be divided into two categories: positive displacement compressors and dynamic compressors. Positive displacement compressors are the most widely used compressors in the market, while centrifugal compressors are only used in large air conditioning systems. With the improvement of energy efficiency in home appliances and the accelerated technological iteration of domestic appliance component companies, the demand for green energy-saving continues to increase. Compressors are the main heat exchange devices in refrigeration, heating, cold storage, freezing, and hot water products. Improving their energy efficiency can greatly optimize the overall energy efficiency of home appliances. Therefore, relevant government departments have issued policies to promote the development of the compressor industry.

2. Current development status: strong industry demand and significant trade surplus

Compressors are the heart of refrigeration systems and an essential part of refrigeration equipment. With the increase in people’s income in recent years, the demand for electrical appliances such as refrigeration and air conditioning has continued to increase. The demand for compressors will also further increase. Taking rotary compressors as an example, the production and sales volume of rotary compressors in China has been on the rise from 2016 to 2021. From import and export data, the export value and quantity of compressors in China are significantly greater than the import value and quantity. The industry has long been in a trade surplus position.

3. Enterprise landscape: enterprise gross profit margin is gradually decreasing, but there is a greater investment in research and development

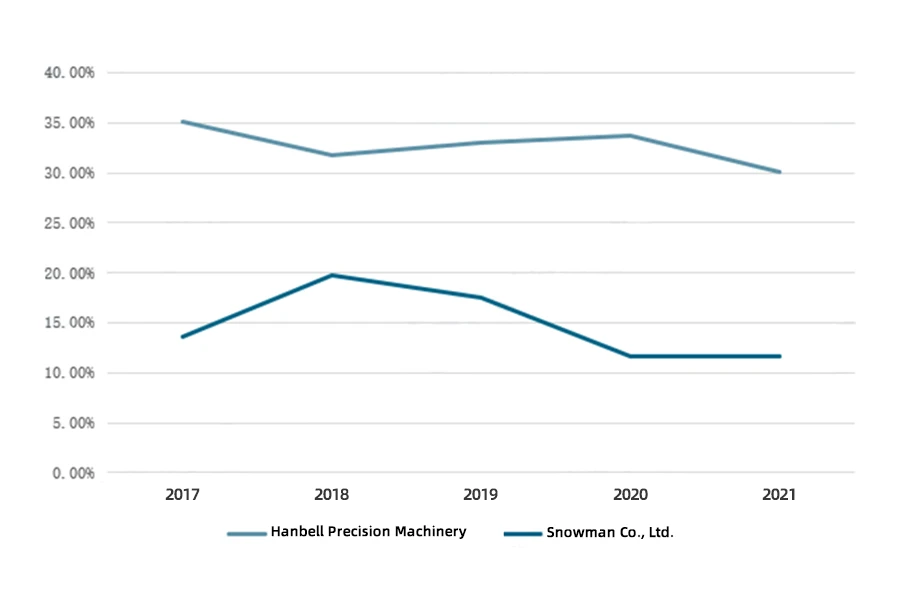

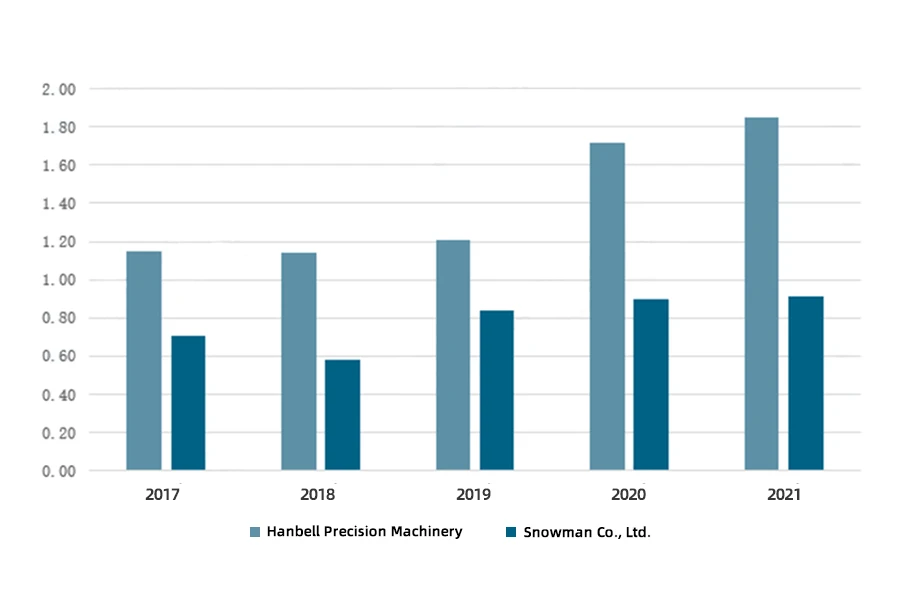

Between 2017 and 2021, Hanbell Precision Machinery’s gross compressor profit margin was on a downward trend, falling from 35.04% in 2017 to 30.14% in 2021. Meanwhile, Snowman Co., Ltd.’s gross compressor profit margin was on an overall trend of first increasing and then decreasing, reaching 11.63% in 2021. Regarding research and development investment, both companies showed an overall upward trend. Hanbell Precision Machinery strengthened its research and development efforts, expanded the scope of technology applications, and in the field of air compressors, it enhanced the research and development progress of centrifugal air compressors and launched related series of products. In refrigeration and cold storage, it launched compressors for different application scenarios, temperature ranges, and refrigerants, covering a wider range of technology applications. Snowman Co., Ltd. focused on the core field of compressors, dug deeper into new demands and application scenarios, and continued to innovate and research in green, low-carbon, high-efficiency, and energy-saving direction.

4. Development trend: industry technology continues to improve, and the requirements for intelligent and information technology are also increasing

Energy conservation and emission reduction are necessary tasks for China’s economic development to transition from high-speed growth to high-quality growth and are also one of the inevitable means to achieve “carbon neutrality.” Against this background, domestic appliance energy efficiency needs to be upgraded and related component efficiency needs to be continuously improved. As the core component of refrigeration systems, compressors have the greatest impact on the entire system’s safety, reliability, and energy efficiency. Therefore, to improve the energy efficiency of household appliances, it is necessary to promote continuous upgrades in compressor technology. At the same time, with the continuous improvement of requirements for intelligent and information technology, the integration of industrial intelligence and information technology is increasing, and the requirements for the intelligent and information technology of compressor equipment are also increasing.

Keywords: Compressors; Imports and exports; Research and development expenses; Development trends

1. Development background: policy-driven industry for energy-saving and efficient development

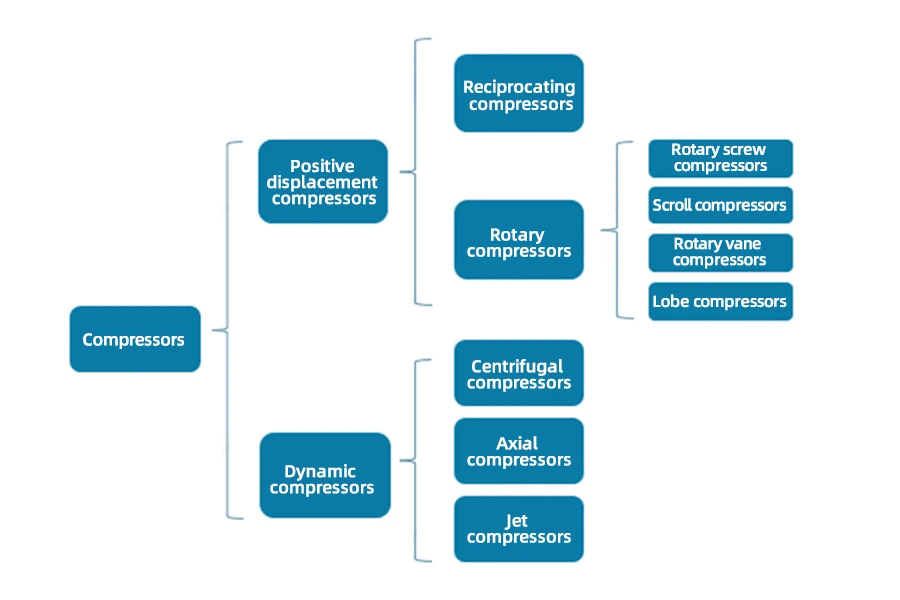

A compressor is a driven fluid machinery that raises low-pressure gas to high-pressure gas and is the heart of a refrigeration system. It sucks in low-temperature and low-pressure refrigerant gas from the suction pipe, compresses it by driving the piston with an electric motor, and discharges high-temperature and high-pressure refrigerant gas to the exhaust pipe, providing power for the refrigeration cycle. Currently, according to different working principles, compressors can be divided into two categories: positive displacement compressors and dynamic compressors. Positive displacement compressors reduce the volume occupied by gas to increase its pressure and are further divided into reciprocating and rotary compressors. Reciprocating compressors only include reciprocating piston types, while rotary compressors include rotary, scroll, screw, and vane types. The other type of dynamic compressor increases the speed of the gas. Then it converts the kinetic energy into potential energy, further divided into the centrifugal, axial flow, and jet types. Currently, positive displacement compressors are widely used in the market, while only centrifugal compressors are used in large air conditioning systems among dynamic compressors.

In recent years, the demand for green energy-saving continued to increase with the improvement of energy efficiency in home appliances and the accelerated technological iteration of domestic appliance component companies. Compressors are the main heat exchange devices in refrigeration, heating, cold storage, freezing, and hot water products. Improving their energy efficiency can greatly optimize the overall energy efficiency of home appliances. Therefore, relevant government departments have issued policies to promote the development of the compressor industry. The “Motor Energy Efficiency Improvement Plan (2021-2023)” issued by the Ministry of Industry and Information Technology and the State Administration for Market Regulation proposes to encourage the use of second-class energy-efficient and above electric motors for general equipment such as compressors, promote the use of second-class energy-efficient and above variable frequency and permanent magnet motors, encourage the use of low-speed direct-drive and high-speed direct-drive permanent magnet motors, and vigorously develop permanent outer magnet rotor electric drums and integrated screw compressors. In October 2021, the State Council issued a notice on the “Action Plan for Peak Carbon Emissions before 2030, “promoting energy-saving and efficiency improvement in key energy-consuming equipment. The focus is on equipment such as motors, fans, pumps, compressors, transformers, heat exchangers, and industrial boilers, and the energy efficiency standards will be comprehensively improved.

2. Current development status: strong industry demand and significant trade surplus

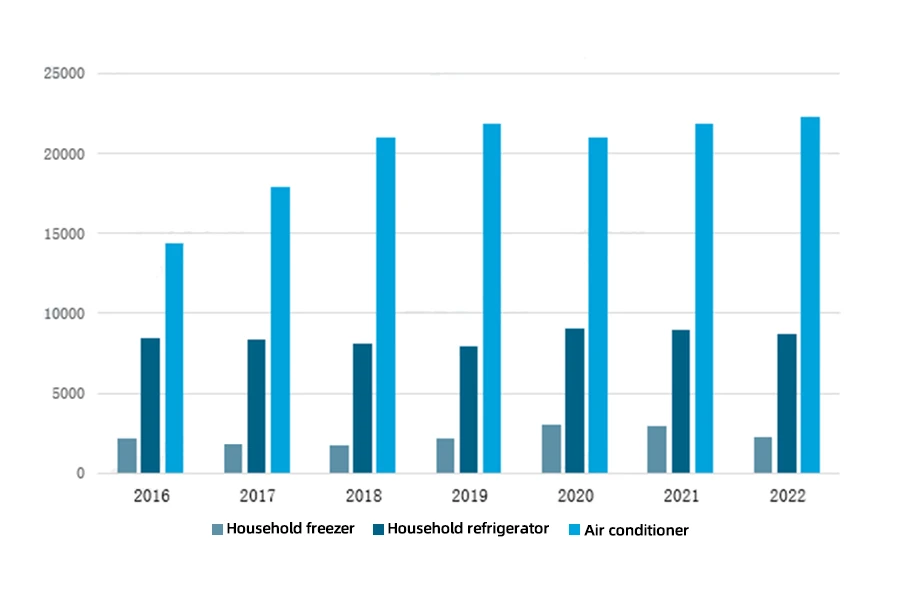

Household appliances are the “big consumers” of residential energy consumption. In terms of specific areas, they are mainly concentrated in refrigeration, air conditioning, and other fields. Compressors are the heart of refrigeration systems and are essential to refrigeration equipment. In recent years, the demand for refrigeration, air conditioning, and other appliances has been increasing with the improvement of people’s income levels. In 2022, China’s freezer production reached 22.602 million units, household refrigerator production reached 86.644 million units, and air conditioner production reached 222.473 million units.

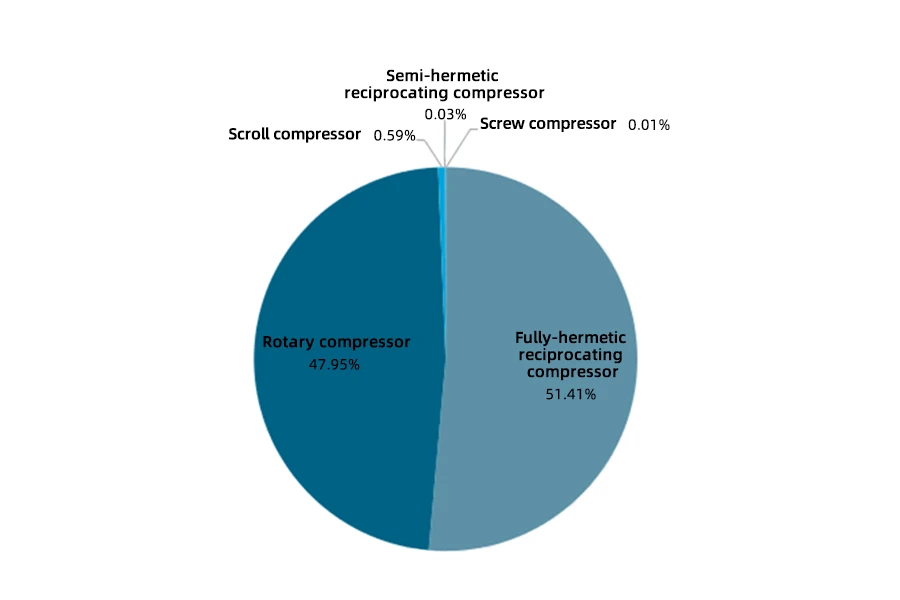

Looking at the market share of the Chinese compressor sub-sectors in 2021, the proportion of fully enclosed piston compressors and rotary compressors exceeded 99%, mainly applied in small refrigeration scenarios such as household refrigerators, freezers, and air conditioners. Among them, the proportion of fully enclosed piston compressors reached 51.41%, and the proportion of rotary compressors reached 47.95%.

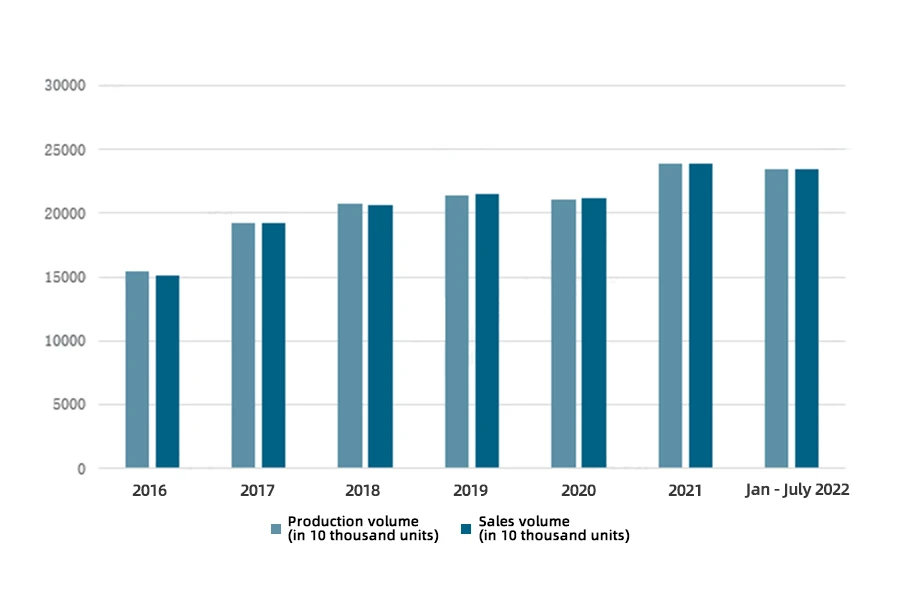

Taking rotary compressors as an example, the production and sales volume of rotary compressors in China from 2016 to 2021 showed an overall upward trend. In 2020, the production and sales volume of rotary compressors slightly decreased due to the impact of the pandemic, reaching 210.411 million units and 211.551 million units, respectively. In 2021, with the economy’s gradual recovery, the production and sales volume gradually rebounded, with a production volume of 238.248 million units and a sales volume of 238.571 million units. From January to July 2022, the production volume of rotary compressors was 234.283 million units, a year-on-year decrease of 2.5%. The sales volume was 234.946 million units, a year-on-year decrease of 1.9%. It can be seen that the future development of China’s compressor industry will maintain an upward trend.

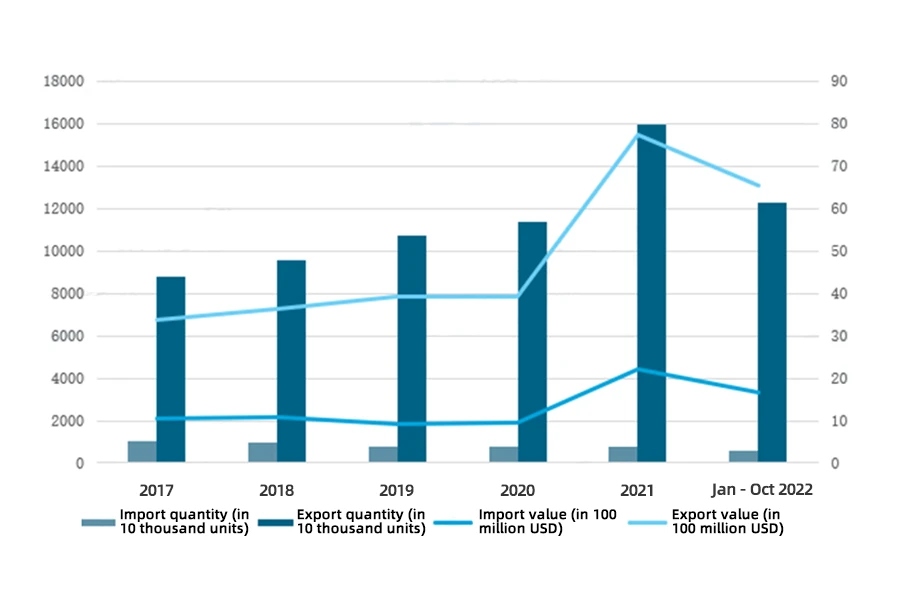

According to China Customs data, the export value and quantity of compressors in China are significantly greater than the import value and quantity. The industry has long been in a trade surplus position. In 2021, China’s compressor imports amounted to 7.87 million units, with an import value of 2.197 billion USD, while exports amounted to 159.83 million units, with an export value of 7.735 billion USD. From January to October 2022, China’s compressor imports amounted to 6.04 million units, with an import value of 1.655 billion USD, while exports amounted to 122.7 million units, with an export value of 6.54 billion USD.

3. Enterprise landscape: enterprise gross profit margin is gradually decreasing, but there is a greater investment in research and development

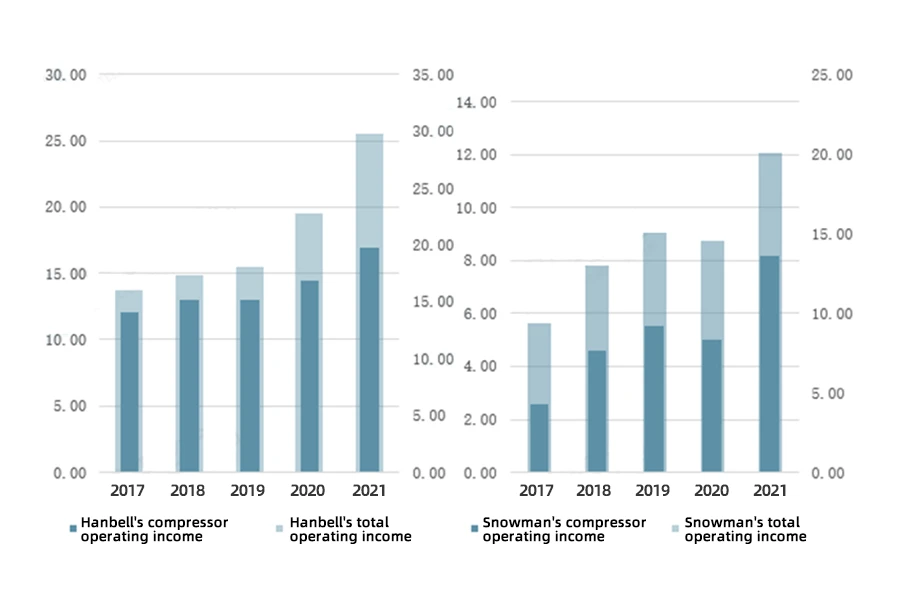

The concentration of the compressor industry is relatively low, and the competitive landscape is relatively scattered. Currently, China’s leading enterprises include Hanbell Precision Machinery, Snowman Co., Ltd., Kaishan Group, Baosi Co., Ltd., and so on. Among them, Hanbell Precision Machinery’s main compressor products include commercial central air conditioning compressors, refrigeration compressors, heat pump compressors, and air compressors. Its revenue has been growing from 2017 to 2021, and the revenue in 2021 was 1.697 billion RMB, an increase of 17.45% year-on-year, accounting for 56.93% of the total revenue. Snowman Co., Ltd. has piston, screw, and centrifugal compressor technologies, with a rich series of compressor products and applications covering cold chain logistics, industrial refrigeration, oil and gas processing, air conditioning heat pumps, and hydrogen energy equipment. The compressor revenue in 2021 was 818 million RMB, an increase of 63.92% year-on-year, accounting for 40.72% of the total revenue.

In terms of compressor gross profit margin, Hanbell Precision Machinery’s gross compressor profit margin is higher than that of Snowman Co., Ltd. From 2017 to 2021, Hanbell Precision Machinery’s compressor gross profit margin has been in a downward trend, decreasing from 35.04% in 2017 to 30.14% in 2021. Snowman Co., Ltd.’s gross compressor profit margin increased to 19.78% in 2018 and decreased to 11.61% in 2020. In 2021, the gross compressor profit margin of Snowman Co., Ltd. was 11.63%.

Hanbell Precision Machinery has strengthened its investment in research and development, expanding its technology application areas. In the field of air compressors, the company has strengthened its research and development of centrifugal air compressors and launched related product lines. Regarding refrigeration and cold storage, the company has launched compressors for different application scenarios, temperature ranges, and refrigerants, covering a wider range of technological applications. In 2021, the company’s R&D expenses reached 185 million RMB, an increase of 7.56% compared to 2020. Snowman Co., Ltd. continues to focus on the core field of compressors, exploring new demand and application scenarios and continuing to research and innovate in green, low-carbon, and efficient energy. In 2021, its R&D expenses were 91 million RMB, an increase of 1.1% compared to 2020.

4. Development trend: industry technology continues to improve, and the requirements for intelligent and information technology are also increasing

4.1 The improvement of product energy efficiency drives the continuous upgrading of technology in the compressor industry

Energy conservation and emission reduction is a task that must be completed in China’s economic development, from high-speed growth to high-quality growth. It is also one of the inevitable means to achieve “carbon neutrality.” In this context, domestic household appliance energy efficiency needs to be upgraded and related component efficiency needs to be continuously improved. The refrigeration system consists of four major components: refrigeration compressors, condensers, evaporators, and throttle valves. Among them, compressors are the core components of the refrigeration system, which have the greatest impact on the entire system’s safety, reliability, and energy efficiency. Therefore, to improve the energy efficiency of household appliances, it is necessary to promote the continuous upgrading of compressor technology. Regarding product frequency conversion, environmentally friendly refrigerants and motor optimization will continue to drive the energy-saving and green upgrading of household appliance compressors. First, frequency conversion technology can further improve the energy efficiency and overall performance of household appliances; second, environmentally friendly refrigerants can be more efficient, energy-saving, environmentally friendly, have no harm to the ozone layer, and have no greenhouse effect; finally, motor optimization can continuously improve the efficiency of energy resource utilization.

4.2 The demand for intelligence and informatization is constantly increasing, and there is huge potential for the future development of oil-free screw air compressors

With the continuous improvement of the requirements for intelligence and informatization, the integration of intelligence and informatization in the industrial field is constantly increasing, and the requirements for the intelligence and informatization of compressor equipment are also increasing. In addition, the oil-free screw air compressor, due to its lack of oil and good air quality, can meet the high-quality air requirements of industries such as pharmaceuticals, food and beverage, electronic products, and textiles. Against the backdrop of increasingly stringent environmental policies in recent years, oil-free screw air compressors have gradually demonstrated their advantages. However, the current domestic market for oil-free screw air compressors is still in its infancy, and there is still ample room for growth in the market capacity of oil-free screw air compressors. Compressor-related enterprises can seize this opportunity, vigorously lay out the oil-free screw compressor business, and further bring performance elasticity to the company and improve its competitiveness.

Source from Intelligence Research Group (chyxx.com)