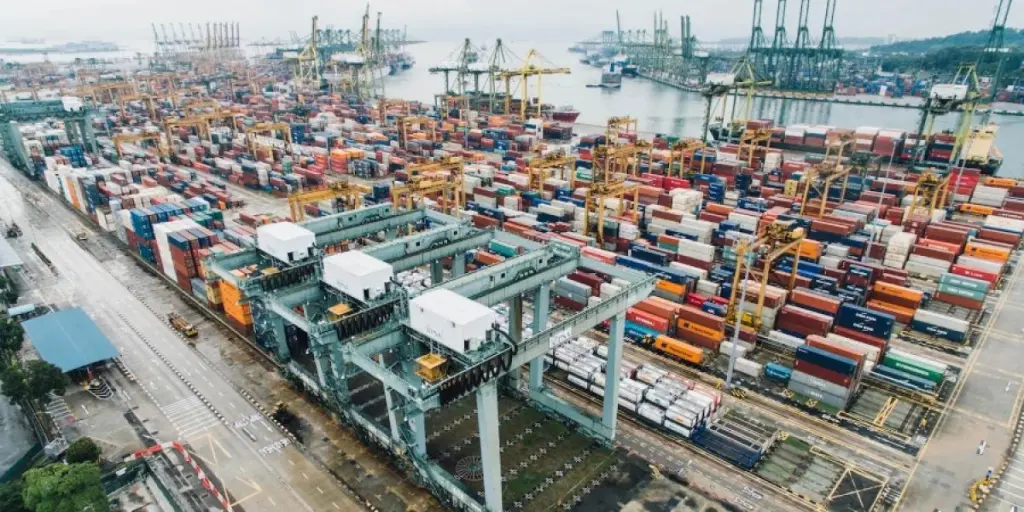

A commercial invoice is among the most important documents in international trade. It is used to support the value and content of goods as well as their origin in front of importing country Customs authorities. This document can simplify customs procedures and help importers avoid unnecessary shipment delays or legal problems with Customs authorities.

This article will go over everything businesses need to know about commercial invoices, including their purpose, the required information they must include, and how they differ from other related shipping documents.

Table of Contents

What is a commercial invoice?

What is the purpose of a commercial invoice?

What are the key details of a commercial invoice?

Commercial invoice vs pro forma invoice

Commercial invoice vs bill of lading

Commercial invoice vs tax invoice

The importance of a proper commercial invoice for shipping

What is a commercial invoice?

A commercial invoice is a special export document used for international shipments and customs purposes. It is typically issued by an exporter/seller to the account of an importer/buyer once the goods have been shipped, and it serves as an official request for payment for those goods.

Commercial invoices for international trade are different from regular sales invoices because they must meet certain legal requirements. They must include additional information about the shipment so that it can pass through international borders, such as the country of origin, total sale value, freight terms, etc. Moreover, they allow Customs authorities to determine how much taxes and import duties are due.

What is the purpose of a commercial invoice in shipping?

A commercial invoice provides evidence of a business transaction between a buyer and a seller. In addition to providing a detailed description of the shipped goods, a commercial invoice serves three core purposes.

Assessment of duties and taxes

The most important purpose of a commercial invoice in shipping is to determine the customs value of goods declared for importation. Customs officials in the buyer’s country must evaluate the economic value of the imported shipment, in order for them to determine the applicable duties and taxes accurately. The duty (and import related taxes, if applicable) will be assessed based on the price paid or payable for the imported goods.

Bill of sale

The commercial invoice is also used to record the details of the export transaction, including the name and address of the buyer and seller, as well as a description of what was purchased. Thus, it serves as proof of sale in case there is any confusion or dispute about the total sale value or the amount owed.

Means of verification

Commercial invoices assist in shipment verification by providing a detailed description of the imported goods, including their quality, quantity, price, and delivery information. This information can help importers verify that their shipments match what was outlined in the original purchase order and the packing list. They can also use it to confirm that all goods are present and accounted for.

What are the key details of a commercial invoice?

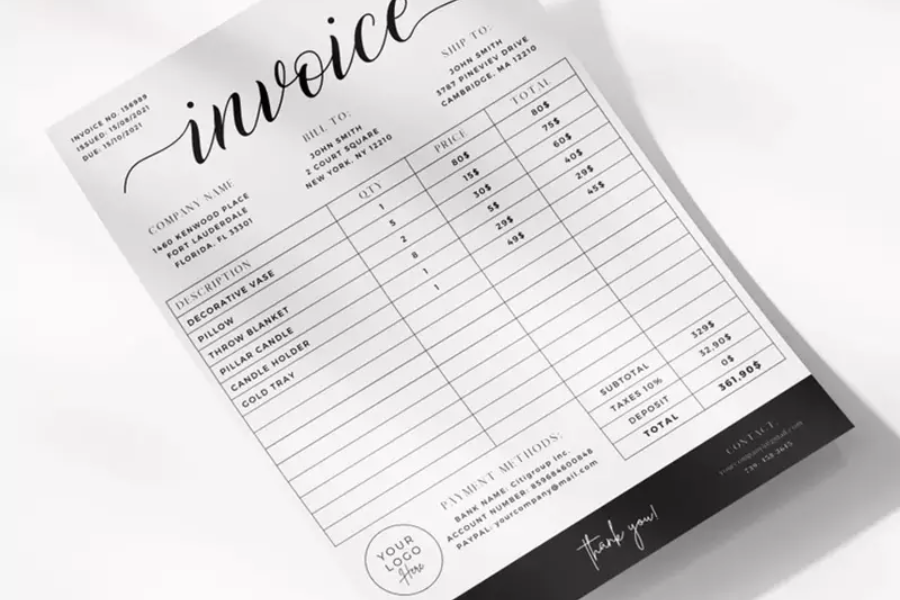

In order for a commercial invoice to have any legal effect, it must include the following key pieces of information.

Header with information about the importer and exporter

The first part of every commercial invoice for international trade, called the header, contains the information that identifies the buyer/importer and the seller/exporter. The exporter’s contact information is listed first and includes the following details:

- Company name

- Physical address

- Phone number

- City and postal code

- Country

The importer’s details will also be listed in this section, right next to the exporter’s contact information:

- Full name of the business

- Physical address

- City and post code

- Country

Invoice number and date

Every commercial invoice should have a unique, sequential ID number to help business parties keep track of each transaction and avoid duplicate payments. Next, make sure the invoice includes an issuance date as well as a due date. This will prevent any confusion about when payments are due, and help prevent any additional fees that may be incurred if payments are late.

Shipment details

Commercial invoices provide Customs officials with the required information needed to process the shipment through customs procedures. This is why it’s important to include an itemized list of shipped goods with the following details:

- Item code

- Name and a brief description of the product

- Quantity and unit of measure (e.g., kilogram or liter)

- Gross weight

- Net weight

- Price per unit

- Total sale amount

Country of origin

When goods are shipped across international borders, the country of origin must be recorded on the commercial invoice. This information helps Customs officials determine whether or not the goods are admissible, or subject to additional trade measures such as temporary tariffs. In international trade, the country of origin is not necessarily the country where a product is exported – there are specific Rules of Origin.

In many cases, a certificate of origin will evidence the economic nationality of goods based on non-preferential rules of origin. These rules determine what constitutes “wholly obtained” products when producing goods in one country; and what constitutes “substantial transformation” if two or more countries are involved in the production of a product.

HS code

A harmonized system (HS) code must be included for each product shipped across international borders. The HS code is a 6-digit number, developed by the World Customs Organization (WCO) to identify and categorize products based on their nature and function. In addition to providing an easy way for countries to classify their goods, HS codes also contribute to the harmonization of customs and trade procedures.

Payment terms and incoterms

Payment terms tell buyers how much time they have to pay for their purchase, and can also help them understand what type of payment methods the exporter accepts. The most common payment terms are the net-30 billing cycle, which means that the buyer has 30 days from the date of the invoice to pay for it. Alternatively, sellers could use a net-45 billing cycle, which gives buyers 45 days to pay for their order.

The commercial invoice should also include information about what incoterm applies to the transaction. Incoterms (International Commercial Terms) are standardized shipping terms that help buyers and sellers clearly communicate risk and responsibilities around delivery times, costs, and shipping arrangements.

Commercial invoice vs pro forma invoice

Proforma invoices are often confused with commercial invoices as they have the same standard format, but they are actually quite different in nature. A proforma invoice, also known as a “predict invoice”, is a contract between the buyer and seller. It outlines the rights and obligations of both parties and provides the buyer with an estimate of the final invoice cost and when the delivery will occur. On the other hand, commercial invoices are the actual bills that help importers clear goods through customs.It’s also worth noting that if no commercial invoice is available, a proforma invoice maybe used as an alternative for import duty purposes (subject to local Customs’ discretion).

Commercial invoice vs bill of lading

Both a bill of lading and a commercial invoice are important parts of the shipping documentation, but they serve different purposes. While the commercial invoice plays an essential role in the determination of data elements for import customs declaration, the bill of lading serves as a legal document that details the terms for the shipment of goods. In other words, a bill of lading acts as a document of title for goods and provides proof that the carrier has accepted responsibility for transporting them.

Commercial invoice vs tax invoice

A tax invoice is an official bill issued by registered suppliers or sellers under the GST (Goods and Services Tax) system. It’s mainly used for domestic transactions or when selling services to overseas customers. But for international trade, where goods are moved across borders, a commercial invoice is required for customs purposes.

The importance of a proper commercial invoice for shipping

A proper and accurately-filled commercial invoice is the best way to ensure that the shipped goods are correctly declared and processed through customs efficiently. If a commercial invoice is inaccurate or incomplete, it can lead to mischarging by the Customs authorities and unnecessary fees. Now that we have learned everything about commercial invoices, let’s dive deeper into shipping documentation!

Looking for a logistics solution with competitive pricing, full visibility, and readily accessible customer support? Check out the Alibaba.com Logistics Marketplace today.