Southeast Asia is one of the fastest-growing regions in the world. With a population of over 684 million people, it is also one of the most populous regions in the world. This makes it an extremely attractive market for many industries, including agriculture.

Agricultural machinery has been used for centuries to help farmers produce more food than they could otherwise achieve with manual labor. Today, agricultural equipment has become much more advanced and efficient. But what makes this market so attractive? What are some of its key drivers? And what are some of the challenges that businesses looking to enter it may face? Read on to get an in-depth look at the Southeast Asian agricultural machinery market!

Table of Contents

Agricultural machinery in Southeast Asia: a market snapshot

4 countries leading the agricultural machinery market

Competitive landscape of the agricultural machinery market

Agricultural machinery in Southeast Asia: a market snapshot

The agricultural machinery market in Southeast Asia is expected to reach about USD 13 billion by 2028 at a CAGR of 7.20%, with tractors being one of the most sought-after farm equipment in the region. SE Asia’s farm machinery market will be on an upward trajectory over the next few years, with investments increasing by regional governments in infrastructure as well as research and development.

Now that we know how fast this market is growing, let’s take a closer look at what drives this growth—and where there are opportunities for businesses to get involved. The following tables provide a snapshot of the key drivers and opportunities, as well as the factors that may hinder the growth of this prosperous market.

Market drivers and restraints

| Market drivers | Market restraints |

| Integration of digital technology allows farmers to maximize their resources and get consistent yields. | The overuse of fertilizers and pesticides can cause soil pollution and water contamination, leading to a loss of productivity. |

| The desire by consumers to eat healthy food drives demand for agricultural machines that can produce more organic crops at lower costs. | In a region where rainfall is already unpredictable, the environmental conditions are becoming more erratic, making it harder to maintain the best soil condition. |

| As labor costs increase, farmers are looking to replace manual labor with agricultural machines that can perform similar tasks more efficiently and with better economic performance. | Farm equipment with diesel engines can have high repair and maintenance expenses, posing a significant barrier to entry for small farmers. |

Market opportunities and threats

| Market opportunities | Market threats |

| Southeast Asian governments are working to increase their crop yields by improving their farmers’ access to more efficient machinery—like combine harvesters. | Harsh weather conditions, such as droughts and floods, make it difficult to maintain large-scale agricultural machinery without substantial investment in infrastructure and maintenance. |

| Labor shortages are driving demand for automation solutions that can help farmers increase productivity without having to hire more workers. | Southeast Asian governments are working to create a more self-sufficient agricultural sector by reducing dependency on imports from China and other countries. |

| Tractors and lawnmowers are expected to be in high demand due to their versatility and durability, as they can be used for various agricultural operations. | Farmers in Southeast Asia tend to have low incomes, which means they may not be able to afford new equipment or even repair parts for existing agricultural machinery. |

4 countries leading the agricultural machinery market

As we have seen, the agricultural equipment market in Southeast Asia is a dynamic and rapidly-growing one. But what is the current state of this market in each country? Luckily, this section will take a closer look at four countries in particular: Vietnam, Thailand, The Philippines, and Indonesia.

Vietnam

With a projected CAGR of 11.5% between 2022 and 2025, the agricultural machinery market in Vietnam is expected to register strong growth over the next five years. Vietnam has a population of nearly 98 million people and a GDP of USD 362.64 billion according to official data from the world bank. The country is home to a flourishing agricultural landscape, with an increasing focus on growing sugar cane, natural rubber, cotton, and rice.

Vietnamese farmers depend heavily on tractors as their main agricultural equipment. According to a report by Mordor Intelligence, tractors account for nearly half of all agricultural machinery sales in Vietnam, with 2 main types: four-wheels and two-wheels. These tractors are used for a variety of agricultural operations, including tillage, mowing, haulage, and loading. 4WD tractors have better traction, which allows them to handle muddy or sandy ground more easily. On the other hand, 2WD tractors are powered by a single axle, making them easier to maneuver in tight spaces.

But as Vietnam becomes increasingly urbanized, farmers will be forced to find ways to increase their productivity with fewer workers available at their disposal. They will turn to smart farming technologies such as automated irrigation systems and high-tech equipment that can be operated remotely. For example, agricultural drones can be programmed to fly over fields with sensors that collect data on soil surface conditions and detect plant health. This data can then be combined with weather information collected by satellites in order to optimize irrigation schedules and determine when crops need more or less water.

Thailand

Thailand’s agricultural industry, along with forestry and fishing, accounts for 8.5% of the country’s GDP, as it is the main income source for 34% of the population. With such a large portion of citizens relying on agriculture and crop activities as their primary source of income, it is no wonder that they have a highly diversified agricultural landscape. As a matter of fact, the country located at the center of the Indochinese Peninsula is home to 20.4 million cultivated hectares, with 50% of this surface used for rice alone.

The country’s dependence on rice cultivation is likely to boost demand for seedlings and planting equipment. Semi-automatic seedling machines are an example of such farm machinery. They select vegetable seeds from storage bins based on their size and shape. Then, the selected seed is dropped into a press hole tube and placed on top of a bed of soil where it will germinate. This process helps farmers increase efficiency and reduce planting errors.

Thailand’s agricultural sector is not just about seedling machines. In fact, the country which was historically known as Siam is primarily characterized by the use of tractors and combine harvesters. The tractor market is expected to register a CAGR of 3.2% between 2022 and 2025, with two-wheel and four-wheel tractors contributing 23% and 77% respectively. The combine harvester market, on the other hand, is expected to grow at a CAGR of 6.6% between 2022 and 2025. This extensive mechanization is due to the aging of the rural population, as young people are no longer interested in farming activities.

The Philippines

The Philippines has more than 7,000 islands and is home to a diverse range of plants and vast forests. As such, it has the fifth largest number of plant species in the world. This abundance of flora makes the Philippines a hotbed for agricultural machinery. In fact, the country’s agricultural equipment market is expected to reach USD 400 million by 2023. This represents a compound annual growth rate of 12.3% during the period of 2021-2023.

Additionally, the irrigated land in the Philippines is projected to increase up to 1.80 million hectares by 2023. As a result, rural communities will start adopting modern irrigation techniques like drip irrigation or sprinklers. Drip irrigation systems consist of small holes drilled into pipes that run below the ground surface; they allow plants to grow closer together while still receiving adequate amounts of water.

The only threat to this growing industry is tariffs and taxes on imported farm equipment, as the government is taking serious efforts to encourage local manufacturing. Additionally, there are cultural barriers preventing some farmers from adopting new technologies, as many Filipinos still believe that hand labor is more efficient than machines because it is cheaper and does not require any type of training.

Indonesia

Indonesia has one of the most robust agricultural sectors in Southeast Asia. According to the World Bank collection of development indicators, Thailand’s agricultural industry accounts for 14% of its GDP and employs more than 27% of its workforce. Moreover, the Indonesian government has set aside USD 538 million to develop agricultural machinery in the country, which will create opportunities for wholesalers and manufacturers who supply equipment parts and components.

In terms of farm equipment types, the use of combine harvesters is expected to replace rice transplanters driven by an increase in global demand for food crops like corn and wheat. But demand for 4-wheel tractors will continue to rise in Sumatra and Kalimantan due to the large farm sizes in these regions. For hand tractors, which are used to till soil and harvest crops on small farms, the Java region will continue to be the area with the highest demand with a CAGR of 5.0% in terms of revenue.

In addition to harvesters and the different types of farm tractors, Indonesian smallholders are likely to increase the usage of disc plows, as they are useful in both dry and wet fields. In dry fields, they can be used to break up hard soil before planting seeds or transplanting plants into the ground. In wet fields, they can help loosen the soil compaction to allow for plant growth and reduce water runoff during heavy rains.

Competitive landscape of the agricultural machinery market

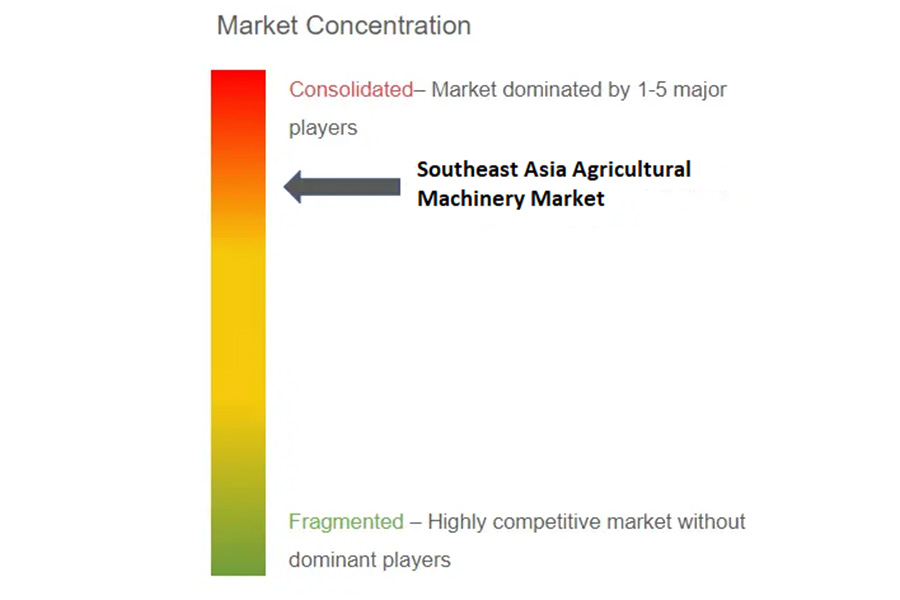

The agricultural machinery market in Southeast Asia is dominated by three well-known brands: John Deere, Kubota, and CNH Industrials. These farm equipment manufacturers control more than 70% of all sales in the region. This dominance is due both to their strong brand recognition and their extensive network of distribution dealers across the region.

This consolidation makes it challenging for smaller players to compete, but the four countries profiled above have different growth potentials due to the differing demographics, environmental conditions, political climates, and overall economic situations. Knowing where each country stands will allow businesses to make informed decisions about which farm equipment to promote. Check the agricultural machinery trends for 2022 to stay ahead of the latest innovations and technological developments!