ESG reporting, like carbon disclosure, is a move by financial institutions and governments to modify investment behavior and encourage investments in sustainable companies. For example, China, the world’s largest carbon emitter, has set targets to reach peak emissions by 2030 and carbon neutrality by 2060.

In short, ESG reporting helps to modify behavior from the bottom up by increasing transparency and encouraging wealth to be invested in better-performing companies based on their environmental, social, and governance aspects.

ESG is making leaps in China as a type of enterprise reform, so what is it? Read on to find out the reason for implementation, the challenges, and how it will take shape in the future.

Table of Contents

What is ESG reporting?

The development of ESG reporting

ESG reporting in China: the timeline

Why is green ESG reporting gaining traction in China?

What are the challenges facing ESG reporting in China?

What is the future of ESG in China?

Conclusion

What is ESG reporting?

ESG stands for Environmental, Social, and Governance—three data sets that allow investors and governments to quantify a company’s dedication to sustainability.

The main function of ESG is to promote sustainable investment practices. Ultimately, where money is invested shapes business development, and replicates sustainable businesses. In addition, the data allows countries to track carbon emissions and pinpoint what needs to change in order to hit carbon targets.

ESG has three components:

- Environmental reporting: This criterion focuses on the actions companies take to protect the environment. For instance, it includes carbon emissions, use of renewables, investments in renewables or climate-protecting charities, and more.

- Social reporting: prioritizes a company’s management of its employees, suppliers, communities, and customers.

- Governance reporting: takes into account the leadership, executive pay, internal control & reports, audits, and shareholder rights.

The development of ESG reporting

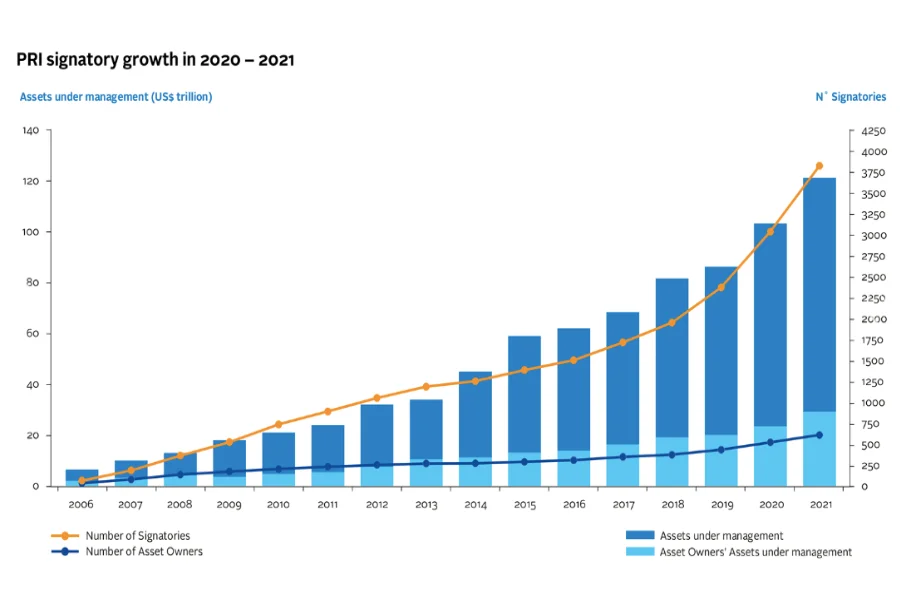

ESG reporting kicked off in 2006 thanks to the United Nations’ Principles for Responsible Investment (PRI). With this report, ESG criteria became a requirement in the financial evaluation of companies to develop sustainable investments further.

In 2006, 63 investment companies signed with a total of $6.5 trillion in assets under management (AUM), which incorporated ESG issues. By March 2021, the PRI had registered a total of $121 trillion in AUM, documenting an increase of 17% from 2020 and an increase of 21% in investor signatories.

ESG reporting in China: the timeline

China has pledged to reach peak emissions by 2030 and carbon neutrality by 2060. Hence, the country must implement changes today without dramatically impacting the economy and creating financial divides.

These changes were set into motion back in 2016 with the following timeline:

- 2016: Seven Chinese authorities, including the People’s Bank of China (PBOC) and the Security Regulatory Commission (CSRC), put the foundations for a mandatory environmental disclosure system for listed companies.

- 2017: The CSRC and the Ministry of Environmental Protection (MEP) jointly signed an agreement to develop the above environmental disclosure bill.

- 2018: The CSRC added the disclosure of ESG to the bill. The Asset Management Association of China (AMAC) published a trial guide on green activities, investments, and a research report on environmental disclosure.

- 2020: The PBOC released a guide on how listed companies should disclose environmental information.

- 2021: The Shenzhen economic zone implemented environmental information disclosure. The CSRC revised the disclosure format to implement annual and semi-annual reports with separate sections to highlight the listed companies’ environmental protection and social responsibility. Also, China’s government officially added the target of peaking carbon emissions before 2030 into its agenda and joined the EU to recognize required actions to tackle climate change.

- 2022: The Ministry of Ecology and Environment’s measures to disclose environmental information become a law in China. And the Chinese government continues to work toward achieving peak emissions by 2030.

Why is green ESG reporting gaining traction in China?

ESG reporting is a great way to motivate businesses to tackle their emissions. By driving investment money toward sustainable companies, China’s economy will continue to thrive while simultaneously transitioning to a greener economy. As a result, it will help China achieve its targets in the Government Work Report, with an action plan released in November 2021.

Further, China has implemented a new standard for ESG disclosure that is more compatible with national business structures. However, it remains voluntary despite plans for regulators to mandate ESG disclosure from the end of 2021. Also, regulators are yet to sign off on this policy, which will slow and limit its effectiveness.

Overall, ESG is increasingly important in China because of the government’s policies, carbon targets, and changing social awareness. Further, consumers are becoming more environmentally aware and may avoid unethical companies.

This avoidance will drive down profits for these companies, which may modify their behavior. Additionally, as their value dips, investors will naturally turn to better-performing and sustainable companies. Also, ESG ratings can help investors make more informed decisions, boost the green transition, and build a more robust economy.

What are the challenges facing ESG reporting in China?

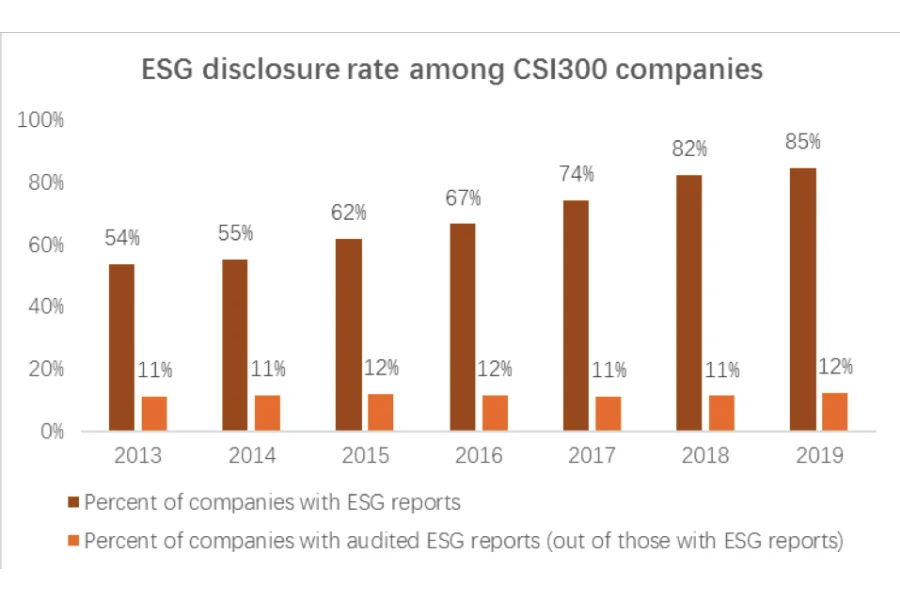

China has reported massive growth in ESG reporting over recent years. According to research by the Ping An Digital Economic Research Center in 2020, 85% of publicly listed companies on the CSI300 were disclosing their ESG by the end of 2019—up from only 54% in 2013. In 2021, there was an ESG surge in China, with the total assets under the management of ESG public funds rising to $39.3 billion, which was almost double the amount of the previous year. In 2022, when comparing the transparency of ESG reporting across continents, Asia is second place, with a score of 56—behind Europe but in front of the US and Australia.

Regardless, China lags in its disclosure and auditing of ESG, with only a small fraction of the disclosing companies being audited. Additionally, reports of greenwashing exist, where some information is excluded to look more sustainable.

There are a few core reasons why ESG reporting remains a challenge in China:

Confusion surrounding guidelines

The many disclosure guidelines, each with multiple stages of implementation, from voluntary to mandatory, have led to confusion surrounding ESG disclosure. In addition, some rules have not been signed off by regulators, and others were pushed back due to Covid-19 regulations and shutdowns.

China has released laws focused on environmental protection and social responsibility to combat this. But there is still no unified ESG disclosure standard. So, it may allow for the continued release of partial, incorrect, or no information.

Lack of suitable processes to collect ESG data

Alongside the confusion is a lack of suitable processes and personnel to collect the data. According to Miotech, there’s improvement with 1,157 companies providing ESG data in 2020 to 1,412 in 2021. However, there has been significantly less disclosure from small to medium enterprises (SMEs) possibly due to lower resources and confusion over the collection processes.

Lack of transparency for foreign investments

ESG disclosure is about investing in sustainable industries. But in China, the as-of-yet insufficient data, and lack of non-Chinese language resources mean that international investors and their foreign capital are excluded from this information. So, guidelines must be clear and homogenous. And the information has to be available in other languages.

ESG reporting’s lack of maturity

Confusing guidelines, lack of resources, and issues in implementation are all signs of a lack of maturity. As ESG reporting matures, processes will become more streamlined, and regulators will control and demand company information. Further, it will lead to tighter rules, a more comprehensive release of data, and stronger controls on greenwashing, which offers better future results.

What is the future of ESG in China?

Despite the challenges, China is poised to tackle its ESG disclosure in a big way. China’s action plan details ways that the country will jump forward to meet its targets, setting out carbon milestones for 2025, 2030, and 2060 (when it aims to be carbon neutral).

Among other targets, the aim by 2025 is for 20% of China’s energy consumption to run off non-fossil fuels to reduce CO2 emissions by 18% compared to 2020. Consequently, it will increase to a share of 25% non-fossil fuels and peak CO2 emissions by 2030 and finally to 80% non-fossil fuels and carbon neutrality by 2060.

Conclusion

China, as an exporting nation, understands that demand drives supply. So, by taking advantage of the social awareness surrounding climate change and the impact global emissions have on that, China aims to use ESG to modify business behavior.

Alibaba.com is one Chinese company that takes this seriously. With a goal of standing strong for 102 years, Alibaba.com believes that ESG holds a key role in measuring its value, responsibility, and longevity in a global green future. Further, the company shares its ESG report annually to show its progress with sustainability and the value it creates.