Key Takeaways:

ESG is becoming a major consideration for businesses as the renewable energy transition speeds up.

AGL Energy is closing its Loy Yang A Power Station in 2035, a decade earlier than planned.

Queensland is phasing out most of its coal-fired electricity by 2035.

A faster transition away from coal affects the electricity subdivision, energy-intensive industries, construction, mining and electric vehicle wholesalers.

Businesses can use contingency planning to proactively respond to fast-moving trends.

ESG momentum is heating up in the public and private sectors

Environmental, social and governance (ESG) is becoming increasingly important for successful businesses as their consumers, investors and shareholders demand concrete action to embrace sustainability. Businesses’ environmental obligations – the E in ESG – are in sharp focus as Australia transitions from fossil fuels to renewables, which has been reflected in fast-evolving trends in the public and private sectors. Companies need to flexibly plan and adapt to these trends, or they risk being left behind.

ESG affects an organisation’s reputation in society. As Australian companies’ social, environmental and governance qualities become increasingly important to consumers, industries that have traditionally had little ESG involvement are being compelled to take positive steps towards sustainability, social responsibility and corporate transparency to stay ahead of the curve. Larger organisations will typically take these actions first, before smaller businesses follow their lead.

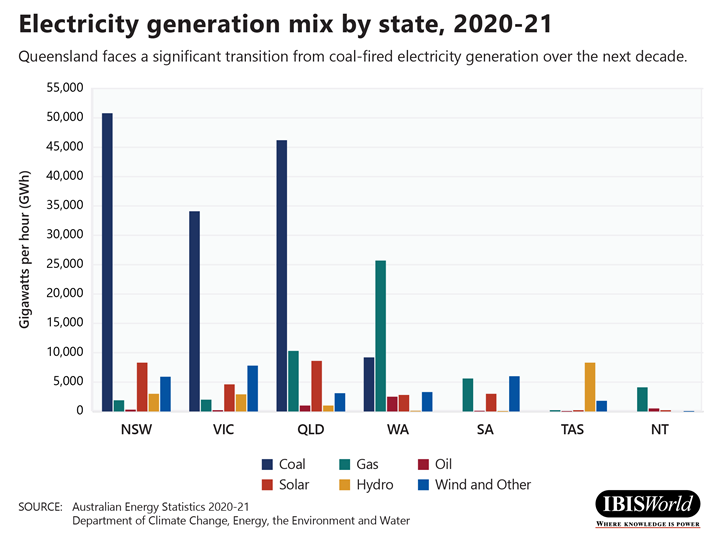

The pressure to reduce emissions is mounting in both the public and private sectors. One of Australia’s largest energy companies, AGL, recently announced plans to close its Loy Lang A coal-fired power station by 2035 – a decade earlier than initially planned. Meanwhile, the Queensland Government is aiming to wean off coal-fired electricity by 2035. These events reflect a wider energy transition as Australia seeks to cut emissions and reduce the country’s reliance on coal for its power needs.

So, what can we learn from these events, and – more importantly – what do they mean for Australian businesses?

Firms need to embrace ESG in their contingency planning, to make the unpredictable a bit more predictable

The energy transition is inherently difficult to predict and riddled with uncertainty, and poses major risks to consumers and businesses alike. Nevertheless, firms can navigate these volatile conditions through embracing contingency planning, with ESG integrated into a proactive approach to risk management.

Contingency planning is simply a Plan B for a specific situation that may arise. Many organisations use it to try and mitigate uncertainty and prevent catastrophic outcomes. As investors and consumers increasingly demand ESG compliance from firms, particularly regarding emissions reduction action, firms need to adjust their risk planning to address these concerns more explicitly – for example, by ensuring their procurement process is ESG compliant throughout the supply chain. Moreover, this approach allows firms to prepare for, and quickly adapt to, high-impact events, such as the potential closure of a major coal-fired power station.

The case of AGL: what does this mean for the electricity subdivision and downstream industries?

AGL’s strategic pivot away from coal-fired electricity highlights how ESG is becoming a major risk factor for corporations. This risk extends beyond consumer expectations to also include shareholder demands and investor sentiment. Amid rising public support for emissions reduction action, major shareholders encouraged AGL to move its Loy Yang A closure forward. Furthermore, the company released a new Climate Transition Action Plan, committing up to $20 billion in renewable and firming capacity investment by 2036.

A faster transition from coal poses a significant risk to fossil fuel electricity generators, given most of Australia’s electricity is from coal. By contrast, a quicker transition means greater investment in renewable capacity, which directly benefits renewable electricity generators, such as hydro, solar and wind. This outcome is good news for wind farm construction and solar panel installation. Heavy construction is also likely to be in demand, as more electricity capacity will need to be supported by strong investment in large-scale transmission and distribution infrastructure.

The fast-tracked closure of large coal-fired stations is projected to drive significant volatility in wholesale electricity prices. A sharp reduction in capacity could create a spike in prices. However, ensuring enough renewable and gas investment is in place would offset some of the lost capacity. Wholesale prices represent approximately one-third of residential retail costs. This strategy would place downward pressure on retail prices over the long term, while effectively cutting Australia’s emissions. Nonetheless, increased investment in transmission and distribution assets, which contribute relatively more to residential retail costs, are likely to limit retail price declines in the short term.

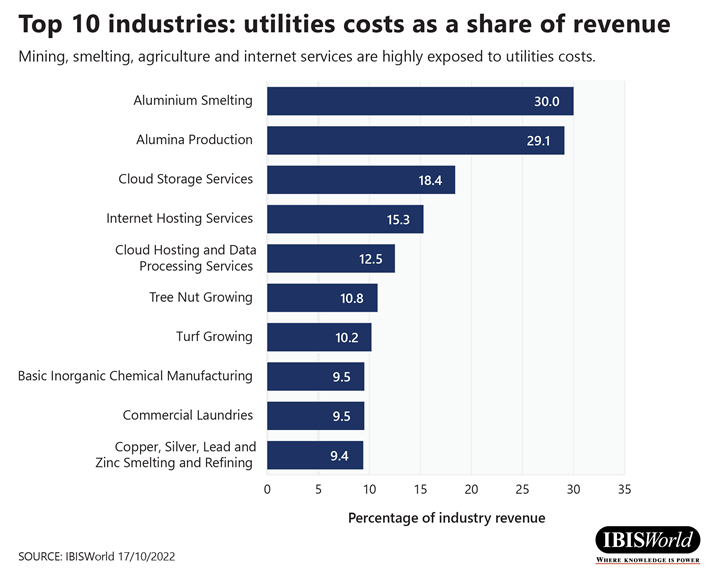

Energy supply and prices affect all businesses to some degree. However, energy-intensive industries are particularly reliant on stable electricity supply, and are therefore susceptible to price fluctuations. For example, aluminium smelters, which extract aluminium from alumina, use electricity extensively in their production processes. Cloud storage, internet hosting and data storage providers also incur substantial utilities expenses, requiring massive amounts of electricity to run large servers. As electricity represents a fundamental cost item for significant power users, potential price increases are expected to constrain these businesses’ profit margins. However, businesses that can more successfully pass on these cost increases will limit the damage to their bottom line.

As the uncertainty of the last few years has shown, businesses need to be adaptable and prepare for all possible outcomes. For businesses in energy-intensive industries, this could mean establishing a plan to review their energy contracts prior to each planned power station closure. Contingency plans, such as back-up energy contracts, may be put in place in case closure timelines are shortened. These mitigation strategies ensure that industry volatility is at least anticipated, if not completely controlled, and that businesses have plans are in place to quickly respond.

Strong government action can provide a clear direction for firms as they navigate stormy waters

Energy-intensive industries, in concert with government, can take proactive steps to maintain consistent supply. For example, the Federal Government’s Australian Renewable Energy Agency (ARENA), which funds energy transition projects, recently approved a $1.5 million grant to get the ball rolling on a new offshore windfarm near Portland, Victoria. The project intends to supply Victoria’s largest electricity consumer, the Portland Aluminium Smelter, with 100% renewable electricity. Its estimated 2028 completion date aligns with EnergyAustralia’s closure of its Yallourn coal-fired power station.

Government-backed renewable projects are projected to generate considerable investment over the next decade, creating strong demand for technical and scientific services. In particular, scientific research, engineering consulting and surveying and mapping services are all likely to benefit from this trend. Businesses in the environmental science services sector are also projected to be in high demand, particularly in assessing the feasibility of potential renewable projects. These businesses’ contribution could be as basic as determining if the proposed location for an offshore wind farm is windy enough to be viable, but is nonetheless a critical step in the expanding renewable project pipeline.

The sunshine state: generating hope for a brighter future

Queensland’s energy plan is a vital signpost for private sector investors. Wind, solar and pumped hydro will gradually ease Queensland’s reliance on coal, with 80% of the state’s electricity derived from renewables by 2035. This trend represents a significant overhaul of the state’s electricity generation mix. Over the next decade, $62.0 billion in investment is estimated from the public and private sectors, which will include funding for wind turbines, solar panels and pumped hydro. The government is also investing in securing employment for, or retraining, workers at state-owned coal generators.

While Queensland’s new direction will decrease demand for coal from electricity generators, the coal mining industry will likely remain unaffected, as only a small proportion of Australia’s coal is consumed domestically. Since Queensland’s plan focuses on overhauling electricity generation, the state’s significant coal exports will likely continue unchecked. Australia is the world’s largest exporter of metallurgical coal, which is used in steel production, and has benefited from highly inflated coal prices.

Other mining industries are projected to capitalise on greater investment in renewables. For example, silica sands, which are a key component in glass manufacturing, are used in photovoltaic solar panels. In addition, wind turbines need steel, copper, aluminium, rare-earth metals and other minerals. As such, cobalt, copper, bauxite, iron ore and gypsum mining are likely to benefit from a nationwide transition towards renewable energy.

Benefits aside, one of the key challenges with renewable electricity is its reliance on wind, rain and sun to maintain consistent supply. Reliable energy storage is crucial to keep the lights on when these inputs are scarce. Lithium-ion batteries are particularly important, as they can store energy efficiently. They are also used in electric vehicles (EVs). As emissions reduction efforts extend to the transport sector, EV wholesalers are also forecast to benefit from the overall electrification of the economy. Consequently, growing demand for batteries is expected to boost demand for lithium mining.

Looking ahead: ESG is a non-negotiable in a volatile energy transition

ESG is becoming a major risk factor across a growing number of industries. As AGL and the Queensland Government move away from coal at a faster pace, firms must adapt to changing conditions in the energy sector. To do so, businesses must embrace effective contingency planning and keep ESG at the forefront of their risk management.

An accelerating transition from coal is likely to benefit renewable electricity generators, mining companies, heavy construction and EV wholesalers. Meanwhile, energy-intensive industries will be highly exposed to volatile electricity markets. These firms must plan for the unexpected, and adapt to the substantial upheaval facing Australia’s energy sector over the coming decade.

Source from IBISWorld.

Disclaimer: The information set forth above is provided by IBISWorld independently of Alibaba.com. Alibaba.com makes no representation and warranties as to the quality and reliability of the seller and products.