The Philippines is one of the most dynamic economies in Southeast Asia. It has a large young population, a growing middle class, and rapid urbanization. Since it’s an expanding economy, there is a growing demand in its industrial machinery market.

Following is a sneak peek of some fundamental factors contributing to the upward trend of industrial machinery in the Philippines. More so, find out why the country’s machinery market is on an upwards trend.

Table of Contents

Overview of the Philippines’ industrial machinery market

6 industrial machinery market trends in the Philippines

Conclusion

Overview of the Philippines’ industrial machinery market

The Philippines is one of the fastest-growing economies in the Asia Pacific. It has a population of around 111.6 million and an area of approx. 300,000 square kilometers. Around 54% of its population lives in cities, and the level of urbanization improves by 2.8%.

Industrial machinery goes hand in hand with urbanization. Some of the industrial machinery synonymous with urbanization include;

Assembly lines: Common in making electrical and mechanical equipment

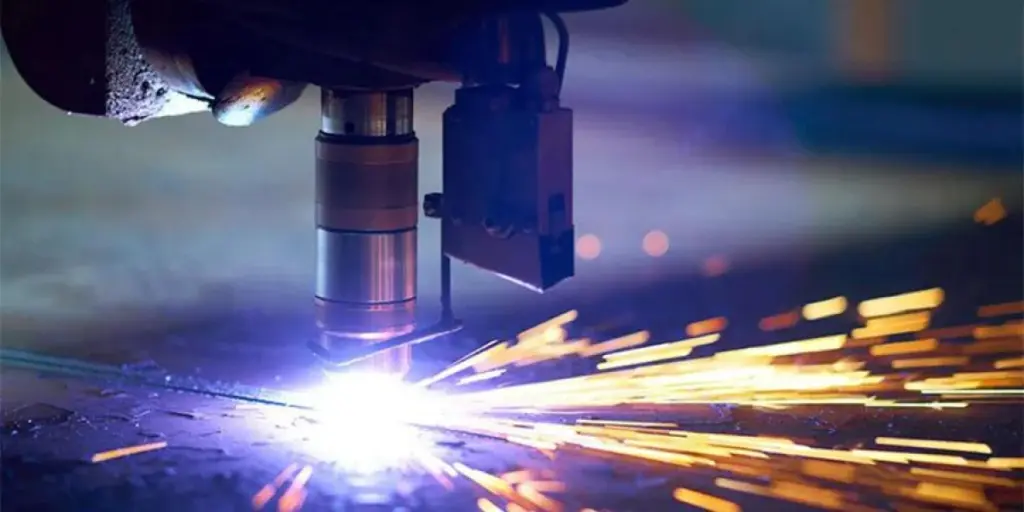

Industrial robots: Used for welding, mechanical cutting, painting, etc.

Packaging and labeling: These are machines used for packaging machinery equipment, electrical, and fast-moving consumable goods (FMCG)

A special mention is the agricultural machinery central to farming to increase food production. Food security is the basis for urbanization. Most urbanites are net food buyers, and the Philippines, with almost half its population residing in its major cities, needs an adequate food supply.

The above machines and others like oil refineries, industrial robots, sawmills, and more are examples of machines at the core of a country’s industrial machinery. In 2021, the manufacturing of machinery and equipment in the Philippines had a value of US$ 38.03 billion, excluding electrical equipment.

6 industrial machinery market trends in the Philippines

Improving infrastructure

As previously mentioned, 54% of Filipinos live in cities. Urbanization is fueled by improving infrastructure built using heavy industrial machines. Improving infrastructure includes roads, commercial buildings, railway interconnectivity, etc.

For instance, the Philippines is focussing on building new roads, railways, and airports to modernize its outdated infrastructure to create an efficient transport network. To effectively build the country’s infrastructure, there will be a demand for more industrial machines like excavators, road rollers, cranes, etc.

The Philippines’ infrastructure is poor in comparison to its regional peers. At the same time, the government is pushing for the country to become an upper-middle-income country. To accomplish the vision, the country increased its public infrastructure investment to over 6% of its GDP in 2022.

Rise in demand for construction machinery

The push by the country’s government to become an upper-middle economy is creating a demand for more construction machinery. At the core of the government’s modernization program are energy, transport, and water resources, which have been identified as bottlenecks.

Earthmoving equipment took 58% of the total cost of construction machinery in 2021 and is expected to rise steadily through 2028. The equipment is pivotal in constructing highways, renewable energy sectors, bridges, etc.

Some of the construction machinery is central to supporting the growth of the private sector for contractors and vendors. The leading machinery equipment brands used in the country include XCMG, Volvo, Caterpillar, SANY, and Komatsu.

Increase of automation in manufacturing

The rapid automation in the world will result in the loss of wages worth US$ 16 trillion for the activities humans are paid to execute. Some of these activities are in the agriculture, retail, and manufacturing sectors.

In the Philippines, automatable work in manufacturing accounts for 2.4 million jobs in manufacturing, 3.4 million in retail, and 6 million in agriculture—the biggest sector. Amongst the three, manufacturing has the largest proportion of work that needs automation, which stands at 61%.

An increase in automation in manufacturing will require the Philippines to re-train its workforce to cope with the changing trend. The demand for automation in manufacturing is inevitable for more efficiency and high production capacities.

Rise of robotics & automation in food manufacturing

Robotics and automation in food manufacturing are becoming the norm. In the Philippines, robotics and automation highly increase the quantity and quality of food production. The general automation process comprises supply, handling, processing, selecting & packing, palletizing, and distribution.

Urbanization means that most Filipinos consume ready-made products that require processing. But some of the food is meant for export other than for local consumption to help grow the country’s economy.

Food exports from the Philippines include bananas, pineapples, mangoes, coconuts, cocoa, etc. For example, 60% of coconut oil imports by the U.S. come from the Philippines.

The emergence of 3D printing and the maker movement

3D printing has become a staple in the printing world since the turn of the 21st century. Filipinos, like the rest of the world, have embraced this technology leveraging it in do-it-yourself activities (DIYs).

Most users are the younger generation who lead in the creative industry. Many young people have grown DIY activities to small startups that generate money for the Philippine economy by creating jobs.

To popularize 3D, the Department of Science and Technology DOST and the Industrial Technology Development Institute in the Philippines have partnered with Colegio de Muntinlupa (CDM) to establish a 3D Printing Training Hub. The aim is to produce technology-ready graduates, especially for the overseas market.

Printing is pivotal in industries such as construction, where architectural drawings are wholesome, manufacturing, medicine, arts, and design. The growth of these industries will continue to spur the demand for the equipment as more Filipinos continue to venture into printing.

Increase in demand for green technology & energy efficiency

The world is steadily moving towards green technologies and energy-efficient products. In April 2019, the Filipino government passed laws regarding energy efficiency through the Energy Efficiency and Conservation Public Act (ECC) 11285. Part of the law mandated efficient energy use in all its government facilities and the promotion of the technology countrywide.

The country has some of the highest electricity rates in the South East Asian region. Reworking the sector will demand heavy-duty machinery like cranes for hoisting windmills for green energy. For electric cars, there’ll be a need to build charging spots that facilitate efficient charging.

Growth of the apparel manufacturing industry

The Philippines has a long history of producing textiles, and this knowledge has resulted in a thriving garment industry. The Philippines has experienced a remarkable expansion in the apparel manufacturing industry in recent years, with numerous new factories and firms opening.

In 2022, the apparel market amounted to US$ 4.58 billion. It is expected to grow at a compound annual growth rate (CAGR) of 5% from 2022 to 2027. Women’s apparel is one of the largest segments, leading with a market volume of US$ 2.08 billion in 2022.

This growth has been fueled by a variety of factors, including low labor costs, a sizable pool of talented people, and a welcoming investment environment. As a result, the Philippines has emerged as a significant center for producing apparel, with several global brands sourcing their clothing from the country.

As the need for clothing is predicted to increase globally, there will be a need for new textile manufacturing machinery to keep up with the demand.

Conclusion

The Philippines, like most countries targeting the upper-middle economy, is investing heavily in modernizing its industries. Since more than half its population resides in cities, the trend will continue increasing demand for industrial machinery.